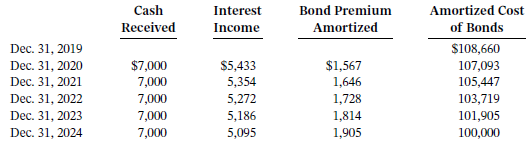

The following amortization schedule is for Flagg Ltd.?s investment in Spangler Corp.?s $100,000, five-year bonds with a

Question:

The following amortization schedule is for Flagg Ltd.?s investment in Spangler Corp.?s $100,000, five-year bonds with a 7% interest rate and a 5% yield, which were purchased on December 31, 2019, for $108,660:

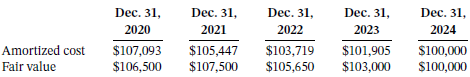

The following schedule presents a comparison of the amortized cost and fair value of the bonds at year end:

Assume that Flagg Ltd. follows IFRS and reports interest income separately from other investment income.

Instructions

a. Prepare the journal entry to record the purchase of these bonds on December 31, 2019, assuming the bonds are accounted for using the amortized cost model.

b. Prepare the journal entry(ies) related to the bonds accounted for using the amortized cost model for 2020.

c. Prepare the journal entry(ies) related to the bonds accounted for using the amortized cost model for 2022.

d. Prepare the journal entry(ies) to record the purchase of these bonds, assuming they are held for trading purposes and accounted for using the FV-NI model.

e. Prepare the journal entry(ies) related to the bonds accounted for using the FV-NI model for 2021.

f. Prepare the journal entry(ies) related to the bonds accounted for using the FV-NI model for 2023.

g. Digging Deeper As a member of Flagg?s management, suggest a reason why you might have a different policy related to the reporting of interest income separately versus combined with other investment income.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy