Question: The following information is available for the first 4 years of operations for Shooting Star Corporation: On January 2, 2022, the firm acquired heavy equipment

The following information is available for the first 4 years of operations for Shooting Star Corporation:

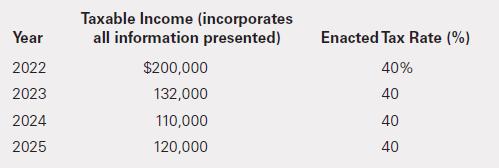

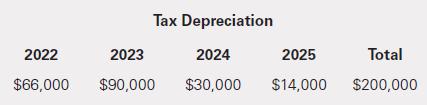

On January 2, 2022, the firm acquired heavy equipment costing $200,000 in a cash transaction. The equipment had a useful life of 5 years and no scrap value. The firm used the straight-line method of depreciation for book purposes; see the following for the tax depreciation taken each year:

On January 2, 2023, the firm collected $120,000 in advance for rental of a building for a 3-year period. The firm reported the entire $120,000 as taxable income in 2023, but $80,000 of the advance collection was unearned at December 31, 2023. The $80,000 was earned evenly over the next 2 years (i.e., 2024 and 2025).

Required

a. Determine the balance of the deferred tax accounts at the end of 2025.

b. Repeat requirement (a) assuming that a newly enacted tax law increased the corporate tax rate to 43%, effective the beginning of 2023.

c. Prepare the journal entries for 2022 and 2023 in requirement (b).

d. Prepare the journal entries for 2023 and 2024 in requirement (b) assuming that based on all available evidence, it is more likely than not that half of the deferred tax asset will not be realized. Reverse out the allowance for the realized portion of the deferred tax asset in 2024.

Year 2022 2023 2024 2025 Taxable Income (incorporates all information presented) $200,000 132,000 110,000 120,000 Enacted Tax Rate (%) 40% 40 40 40

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

a b c Analysis of GAAP Tax differences and computation of GAAP inc... View full answer

Get step-by-step solutions from verified subject matter experts