The following information is available for the first 4 years of operations for Shooting Star Corporation: On

Question:

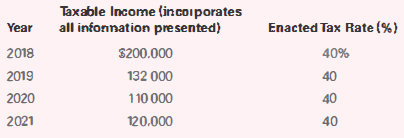

The following information is available for the first 4 years of operations for Shooting Star Corporation:

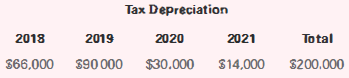

On January 2, 2018, the firm acquired heavy equipment costing $200,000 in a cash transaction. The equipment had a useful life of 5 years and no scrap value. The firm used the straight-line method of depreciation for book purposes; see the following for the tax depreciation taken each year:

On January 2, 2019, the firm collected $120,000 in advance for rental of a building for a 3-year period. The firm reported the entire $120,000 as taxable income in 2019, but $80,000 of the advance collection was unearned at December 31, 2019. The $80,000 was earned evenly over the next 2 years (i.e., 2020 and 2021).

Required

a. Determine the balance of the deferred tax accounts at the end of 2021.

b. Repeat requirement (a) assuming that a newly enacted tax law increased the corporate tax rate to 43%, effective the beginning of 2019.

c. Prepare the journal entries for 2018 and 2019 in requirement (b).

d. Prepare the journal entries for 2019 and 2020 in requirement (b) assuming that based on all available evidence. It is more likely than not that half of the deferred tax asset will not be realized. Reverse out the allowance for the realized portion of the deferred tax asset in 2020.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella