The Jiayin Li Corporation, which is a technology company, was formed on January 1 of the current

Question:

The Jiayin Li Corporation, which is a technology company, was formed on January 1 of the current year. Transactions completed during the first year of operation follow.

January 1: Issued 1,000,000 shares of common stock for $15,000,000, which is the par value of the stock.

January 10: Acquired equipment in exchange for $2,000,000 cash and a $5,000,000 note payable.

The note is due in 10 years.

February 10: Paid $48,000 for a business insurance policy covering the two-year period beginning on March 1.

February 14: Purchased $900,000 of supplies on account

March 1: Paid wages of $195,000.

March 15: Billed $2,500,000 for services rendered on account

April 13: Paid $125,000 of the amount due on the supplies purchased on February 14.

April 17: Billed $2,000,000 for services rendered on account

May 1: Paid wages of $200,000.

May 7: Collected $200,500 of the outstanding accounts receivable.

May 8: Received bill and paid $96,500 for utilities.

May 24: Paid $40,000 for sales commissions.

June 4: Made the first payment on the note issued on January 10. The payment consisted of $50,000 of interest and $150,000 to be applied against the principal of the note.

June 18: Billed customers for $646,000 of services rendered.

June 29: Collected $450,000 on accounts receivable.

July 10: Purchased $45,000 of supplies in cash.

Aug 25: Paid $120,000 for administrative expenses.

Sept 23: Paid $35,500 for warehouse repairs.

October 1: Paid wages of $100,000.

Nov 23: Purchased supplies for $500,000 on account.

Dec 19: Collected $150,000 in advance for services to be provided in December and January of the following year.

Dec 30: Declared and paid a $20,000 dividend to shareholders.

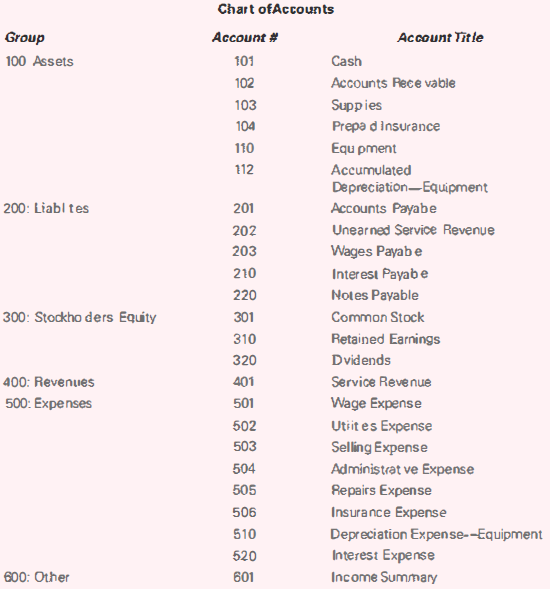

The chart of accounts used by Jiayin Li is presented here:

a. Journalize the transactions for the year.

b. Post the journal entries to T accounts.

c. Prepare an unadjusted trial balance as of December 31.

d. Journalize and post adjusting entries to t-accounts based on the following additional information.

i. Ten months of the insurance policy had expired by the end of the year.

ii. Depreciation for the equipment is $380,000.

iii. The company provided a portion of the services related to the advance collection of December 19. The company recognized $50,000 as service revenue for services performed.

iv. An additional $160,000 of interest had accrued on the note by the end of the year.

v . Jiayin Li Corporation accrued wages in the amount of $200,000.

e. Prepare an adjusted trial balance as of December 31.

f. Prepare a single-step income statement and statement of stockholders' equity for the current year and a classified balance sheet as of the end of the year.

g. Journalize and post closing entries.

h. Prepare a post-closing trial balance as of December 31.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella