The Umbro Company, which is a fitness center, was formed on January 2 of the current year.

Question:

The Umbro Company, which is a fitness center, was formed on January 2 of the current year. Transactions completed during the first year of operation are presented below.

January 2: Issued 900,000 shares of common stock for $15,000,000, which is the par value of the stock.

January 10: Acquired equipment in exchange for $2,500,000 cash and a $6,000,000 note payable. The note is due in 10 years.

February 1: Paid $36,000 for a business insurance policy covering the two-year period beginning on February 1.

February 22: Purchased $930,000 of supplies on account.

March 1: Paid wages of $194,600.

March 23: Billed $2,820,000 for services rendered on account.

April 1: Paid $130,000 of the amount due on the supplies purchased on February 22.

April 17: Collected $190,000 of the outstanding accounts receivable.

May 1: Paid wages of $209,400.

May 8: Received bill and paid $96,700 for utilities.

May 24: Paid $45,500 for sales commissions.

June 1: Made the first payment on the note issued on January 10. The payment consisted of $50,000 of interest and $210,000 to be applied against the principal of the note.

June 16: Billed customers for $680,000 of services rendered.

June 30: Collected $450,000 on accounts receivable.

July 10: Purchased $166,000 of supplies on account.

Aug 25: Paid $150,000 for administrative expenses.

Sept 23: Paid $35,000 for warehouse repairs.

October 1: Paid wages of $100,000.

Nov 20: Purchased supplies for $45,000 with cash.

Dec 15: Collected $134,700 in advance for services to be provided in December and January of the following year.

Dec 30: Declared and paid a $50,000 dividend to shareholders.

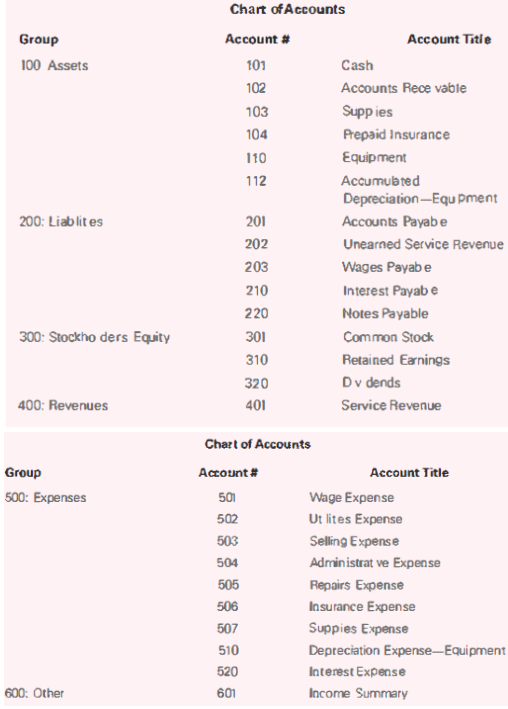

The chart of accounts used by the Umbro Company follows:

a. Journalize the transactions for the year.

b. Post the journal entries to t-accounts.

c. Prepare an unadjusted trial balance as of December 31.

d. Journalize and post adjusting entries to t-accounts based on the following additional information.

i. Eleven months of the insurance policy expired by the end of the year.

ii. Depreciation for the equipment is $420,000.

iii. The company provided a portion of the services related 10 the advance collection of December 15. The company recognized $72,000 as service revenue for services performed.

iv. There are $501,000 of supplies on hand at the end of the year.

v. An additional $172,000 of interest has accrued on the note by the end of the year.

vi. Umbro accrued wages in the amount of $240,000.

e. Prepare an adjusted trial balance as of December 31.

f. Prepare a single-step income statement and statement, of stockholders' equity for the current year and a classified balance sheet as of the end of the year.

g. Journalize and post closing entries.

h. Prepare a post-closing trial balance as o f December 31.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella