[This exercise is a continuation of Exercise 10?4 in Chapter 10 focusing on depletion and depreciation.]Jackpot Mining

Question:

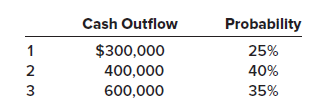

[This exercise is a continuation of Exercise 10?4 in Chapter 10 focusing on depletion and depreciation.]Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,000,000 in 2021 for the mining site and spent an additional $600,000 to prepare the mine for extraction of the copper. After the copper is extracted in approximately four years, the company is required to restore the land to its original condition, including repaving of roads and replacing a greenbelt. The company has provided the following three cash flow possibilities for the restoration costs:

To aid extraction, Jackpot purchased some new equipment on July 1, 2021, for $120,000. After the copper is removed from this mine, the equipment will be sold for an estimated residual amount of $20,000. There will be no residual value for the copper mine. The credit-adjusted risk-free rate of interest is 10%. The company expects to extract 10 million pounds of copper from the mine. Actual production was 1.6 million pounds in 2021 and 3 million pounds in 2022.

Required:1. Compute depletion and depreciation on the mine and mining equipment for 2021 and 2022. The units-ofproduction method is used to calculate depreciation.2. Discuss the accounting treatment of the depletion and depreciation on the mine and mining equipment.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas