Use the following excerpt of Dragonfly Corporation's asset balances to compute Dragonfly's working capital and current ratio

Question:

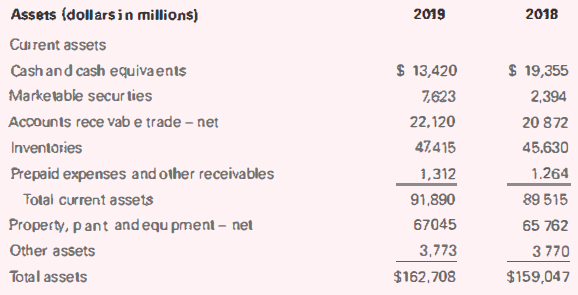

Use the following excerpt of Dragonfly Corporation's asset balances to compute Dragonfly's working capital and current ratio for 2019 and 2018. Comment on Dragonfly's liquidity and changes in liquidity from 2018 to 2019. Dragonfly's current liabilities are $89,754 million and $82,271 million in 2019 and 2018. respectively.

Assets (dollarsin millions) 2019 2018 Cuirent assets $ 13,420 $ 19,355 Cash and cash equivaents Marketable secur ties 7,623 2,394 Accounts rece vab e trade – net 22,120 20 872 47,415 Inventories 45,630 Prepaid expenses and other receivables 1.264 1,312 89 515 Total current assets 91,890 Property, p ant andequ pment – net 67045 65 762 Other assets 3,773 3770 Total assets $162,708 $159,047

Step by Step Answer:

2019 2018 Working Capital Computation Total current assets 91890 ...View the full answer

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella

Related Video

The current ratio is a financial ratio that measures a company\'s ability to pay its short-term obligations with its short-term assets. It is calculated by dividing a company\'s current assets by its current liabilities. The formula for calculating the current ratio is: Current Ratio = Current Assets / Current Liabilities Current assets are assets that can be converted to cash within one year, while current liabilities are debts that are due within one year. A current ratio of 1:1 or greater is generally considered good, as it indicates that a company has enough current assets to cover its current liabilities. A current ratio of less than 1:1 may suggest that a company may have difficulty meeting its short-term obligations. It\'s important to note that the current ratio is just one of many financial ratios that can be used to assess a company\'s financial health. It should be used in conjunction with other financial ratios and qualitative factors to make informed decisions about investing or lending to a company.

Students also viewed these Business questions

-

Use the excerpt of Dragonfly Corporations balance sheet and its income statement below to compute Dragonflys profit margin and return on assets for 2015 and 2016. Comment on Dragonflys profitability...

-

Use the excerpt of Dragonfly Corporations asset balances below to compute Dragon-flys working capital, and current ratio for 2016 and 2015. Comment on Dragonflys liquidity and changes in liquidity...

-

Use the following excerpt from Dragonfly Corporation's balance sheer and its income statement to compute Dragonfly's profit margin and return on assets for 2018 and 2019. Comment on Dragonfly's...

-

The mass of the crane?s boom is 9000 kg. Its weight acts at?G. The sum of the moments about?P?due to the boom?s weight, the force exerted at?B?by the cable?AB,?and the force exerted at?C?by the...

-

Before the discovery of the neutron, one theory of the nucleus proposed that the nucleus contains protons and electrons. For example, the helium-4 nucleus would contain 4 protons and 2 electrons...

-

Patio Corporation owns 60 percent of the stock of Stone Container Company, which it acquired at book value in 20X1. At that date, the fair value of the noncontrolling interest was equal to 40 percent...

-

Evaluate the range of selection methods that are available (interviewing will be dealt with in detail later (see Part

-

Power Serve Company expects to operate at 85% of productive capacity during April. The total manufacturing costs for April for the production of 30,000 batteries are budgeted as follows: Direct...

-

Montgomery Equipment Rental Company received $1,000 cash from a customer; the amount was owed to the business from the previous month. What is the effect of this transaction on the accounting...

-

The Cheesecake Factory Incorporated (NASDAQ: CAKE) was started by Evelyn Overton when she sold cheesecakes from her basement in Detroit in the 1940s. Its first restaurant opened in Beverly Hills in...

-

Use Johnson & Johnson's 2016 Annual Report, 10-K, to answer the following questions. You can locate Johnson & Johnson's financial statements on its web site, the Securities and Exchange Commission's...

-

The following items are from the financial statements of Tall Oak Company. Compute Tall Oak's debt-to-equity ratio and interest coverage ratio for 2018 and 2019. Comment on Tall Oak's solvency and...

-

How many ratings does S&P use for companies that have not defaulted? What are they?

-

Question 1- Visit the Boots and Hearts Festival website: www.bootsandhearts.com. Using the information you find on the site, make an analysis of the festival's Strengths, Weaknesses, Opportunities...

-

You will be creating a Performance Improvement Plan to address an employee in the attached case study (see below). This is a scenario you may encounter in your future HR profession, so this...

-

For this prompt, consider your academic goals, including (but not limited to) such topics as how you plan to manage your time to fit in your studies; how you will build your skills, as needed; how...

-

1. An introduction of you as a leader (whether or not you see yourself as a leader, whether or not you like being a leader, what kinds of leadership roles you have had, etc.). 2. Summarize your...

-

Briefly, describe the firm in terms of the following items. a. Size in terms of market capitalization, annual revenue, number of employees, location(s). b. Discuss the financial position of the firm....

-

At what nominal rate compounded continuously must money be invested to double in 8 years?

-

President Lee Coone has asked you to continue planning for an integrated corporate NDAS network. Ultimately, this network will link all the offices with the Tampa head office and become the...

-

Elegant Homes Corporation provided the following statement of net income on December 31, 2017, before the disposal of a business segment. The income statement includes the results of operations of...

-

Dane Products, Incorporated provided the following information for the current year ended December 31. Required Prepare a Statement of Stockholders Equity for the current year. Retained Earnings,...

-

Bluebird Products, Inc. provided the following information from its current- year trial balance. Required a. Prepare a single step income statement for the year ended December 31. The tax rate is...

-

Practicum Co. pad $1.2 million for an 80% interest in the common stock of Sarong Co. Practicum had no previous equity interest in Sarong. On the acquisition date, Sarong's identifiable net assets had...

-

On Dec 31 2020, Bernice Melson, a partner in ABC Communications, had an ending capital balance of $49,000. Her share of the partnership's profit was $18,000; she made investments of $12,000 and had...

-

Q2R. on account for each depreciable asset. During 2024, Jane VIIS nsactions.) i More Info Apr. 1 Purchased office equipment. 5111,000. Paid 581,000 cash and financed the remainder Jan. 1 with a note...

Study smarter with the SolutionInn App