Use the information in E5.17 for Dropafix Inc. Instructions a. Calculate the current and acid-test ratios for

Question:

Use the information in E5.17 for Dropafix Inc.

Instructions

a. Calculate the current and acid-test ratios for 2019 and 2020.

b. Calculate Dropafix’s current cash debt coverage ratio for 2020.

c. Calculate Dropafix’s cash debt coverage ratio for 2020.

d. Calculate Dropafix’s times interest earned ratio for 2020.

e. Based on the analyses in parts (a) through (d), comment on Dropafix’s liquidity, financial flexibility, and ability to repay current and all liabilities from its operations and ability to meet interest payments as they come due.

f. Digging Deeper Looking at the statement of income, the statement of financial position, and the statement of cash flows, provide one recommendation that could improve Dropafix’s liquidity, financial flexibility, and ability to repay current and all liabilities from its operations.

E5.17

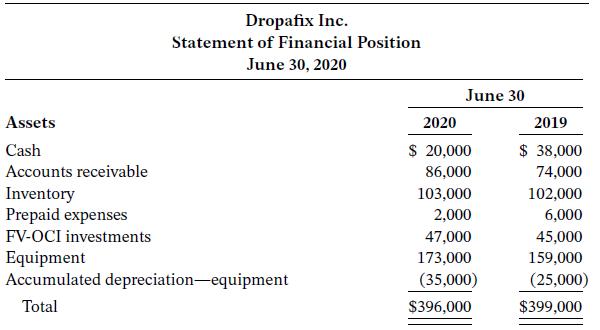

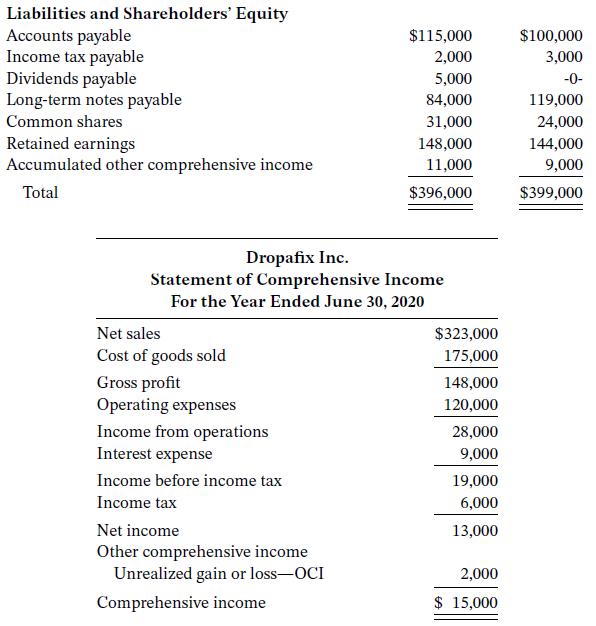

The comparative statement of financial position of Dropafix Inc. as at June 30, 2020, and a statement of comprehensive income for the 2020 fiscal year follow:

Dropafix Inc.

Statement of Comprehensive Income

For the Year Ended June 30, 2020

Net sales ................................................................. $323,000

Cost of goods sold ................................................... 175,000

Gross profit ............................................................... 148,000

Operating expenses ................................................. 120,000

Income from operations ............................................ 28,000

Interest expense ........................................................... 9,000

Income before income tax ........................................ 19,000

Income tax .................................................................... 6,000

Net income ................................................................. 13,000

Other comprehensive income

Unrealized gain or loss—OCI ...................................... 2,000

Comprehensive income .......................................... $ 15,000

Additional information:

1. Dropafix follows IFRS. Assume that interest is treated as an operating activity for purposes of the statement of cash flows.

2. Operating expenses include $10,000 in depreciation expense.

3. There were no disposals of equipment during the year.

4. Common shares were issued for cash.

5. During the year, Dropafix acquired $8,000 of equipment in exchange for long-term notes payable.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy