Use the information in E5.18 for Sensify Corporation. Instructions a. Calculate the current ratio and debt to

Question:

Use the information in E5.18 for Sensify Corporation.

Instructions

a. Calculate the current ratio and debt to total assets ratio as at December 31, 2019 and 2020. Calculate the free cash flow for December 31, 2020.

b. Based on the analysis in part (a), comment on the company?s liquidity and financial flexibility.

E5.18

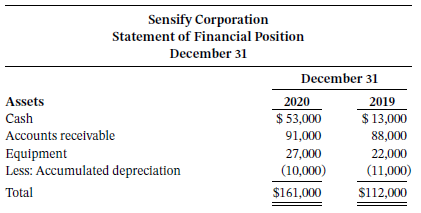

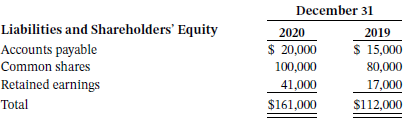

The comparative statement of financial position of Sensify Corporation as at December 31, 2020, follows:

Net income of $37,000 was reported and dividends of $13,000 were declared and paid in 2020. New equipment was purchased, and equipment with a carrying value of $5,000 (cost of $12,000 and accumulated depreciation of $7,000) was sold for $8,000.

Free Cash FlowFree cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy