Using the information provided in E8-13, prepare the journal entries for each year to record the contract,

Question:

Using the information provided in E8-13, prepare the journal entries for each year to record the contract, assuming that Gary uses the completed-contract method (show all supporting computations).

Data from E8-13

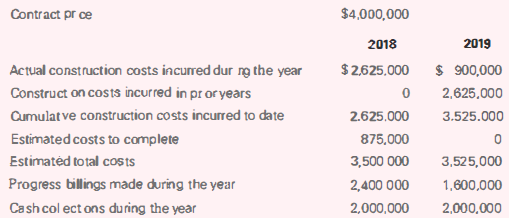

Gary Construction Associates accepted a contract to build an office building on January 2, 2018. The company will complete the contract within two years. Gary provided the following information related to the revenue, estimated costs, progress billings, and collections over the two-year period.

$4,000,000 Contract pr ce 2019 2018 $ 900,000 Actual construction costs incurred dur ng the year $2,625,000 Construct on costs incurred in pr or years 2,625,000 Cumulatve construction costs incurred to date 2.625.000 3.525.000 Estimated costs to complete 875,000 Estimatéd to tal costs 3,525,000 3,500 000 Progress billings made during the year 2,400 000 1,600,000 Cash col ect ons during the year 2,000,000 2,000,000

Step by Step Answer:

2018 2019 Account Debit Credit Debit Credit Construction in ...View the full answer

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Bailey Builders Corporation accepted a three-year, $1,000,000 fixed-fee contract to renovate a parking deck. Bailey uses the percentage-of-completion method and the cost-to-cost method of measuring...

-

On April 7, 2020, McCool Systems signed a contract to develop and install a virtual private network (VPN) for Billy Majors Stores. The transaction price, including installation, is $580,000. The VPN...

-

Convert the following indirect quotes to direct quotes and direct quotes to indirect quotes: a. Euro: 1.22/$ (indirect quote); b. Russia: Rub 30/$ (indirect quote); c. Canada: $0.72/C$ (direct...

-

The following are selected account balances from Cheela Company and Jarjar Corporation as of December 31, 2018: Cheela Jarjar Revenues P 980,000 P 560,000 Expenses 560,000 420,000 Dividend Income...

-

(a) Find the magnitude of the angular momentum L for an electron with n = 2 and = 1 in terms of . (b) What are the allowed values for Lz? (c) What are the angles between the positive z -axis and L...

-

In Problems 5 44, solve each logarithmic equation. Express irrational solutions in exact form. log (x + 1) + log (x + 7) = 3

-

Northwest Company produces two types of glass shelving, rounded edge and squared edge, on the same production line. For the current period, the company reports the following data. Northwests...

-

A 2012 Gallup Poll reported that only 581 out of a total of 2004 U.S. adults said they had a great deal of confidence or quite a lot of confidence in the public school system. This was down 5...

-

Question 8 2 pts Ethan Corporation began 2020 with an $8,000 balance in accounts receivable and a $400 balance in the allowance for doubtful accounts. During the year 2020, the company had credit...

-

A shaft is to be designed to support the spur pinion and helical gear shown in the figure on two bearings spaced 700 mm center-to-center. Bearing A is a cylindrical roller and is to take only radial...

-

Gary Construction Associates accepted a contract to build an office building on January 2, 2018. The company will complete the contract within two years. Gary provided the following information...

-

Using the information provided in ES-15, assume that Bailey uses the completed-contract method. Prepare the journal entries required in each year to record the contract (show all supporting...

-

In 1979, JCB, the large British manufacturer of construction equipment, entered into a joint venture with Escorts, an Indian engineering conglomerate, to manufacture backhoe loaders for sale in...

-

The maximum employee earnings on which labour standards plan will be calculated on in 2019 was: Question 1 options: a) 67,500 b) 79,500 c) 86,500 d) 76,500 Question 2 (1 point) Question 2 options:...

-

Based on a survey, assume that 42% of consumers are comfortable having drones deliver their purchases. Suppose that we want to find the probability that when six consumers are randomly selected,...

-

What is the social location that determines this speech community? Is it determined by race, class, gender, sexuality, or some other social location? What makes this speech community unique? What are...

-

Write a program named SumOfNumberOfSquares.java that prompts user to enter a number of integers and calculates the sum of their squares. The following is a sample run. The green fonts represent user...

-

6.4 Charles Augustin de Coulomb was a French physicist who is best known for formulating the law that calculates the force between two electric charges. To honor Coulomb, the unit of electric charge...

-

In Problem find f(x) and simplify. f(x) = (1 + ln x) 3

-

The sales department of P. Gillen Manufacturing Company has forecast sales in March to be 20,000 units. Additional information follows: Finished goods inventory, March 1 . . . . . . . . . . . . . . ....

-

A list of cash receipts and cash payments for Tucson Telecommunications is presented below. Compute cash flows from operating activities under the direct reporting format. Cash Receipts and Payments...

-

Identify whether each item below is added or subtracted from net income to compute cash flows from operating activities under the indirect method. Add or Subtract from Net Income to Compute Cash...

-

List and explain the three primary disadvantages of the statement of financial position.

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

Study smarter with the SolutionInn App