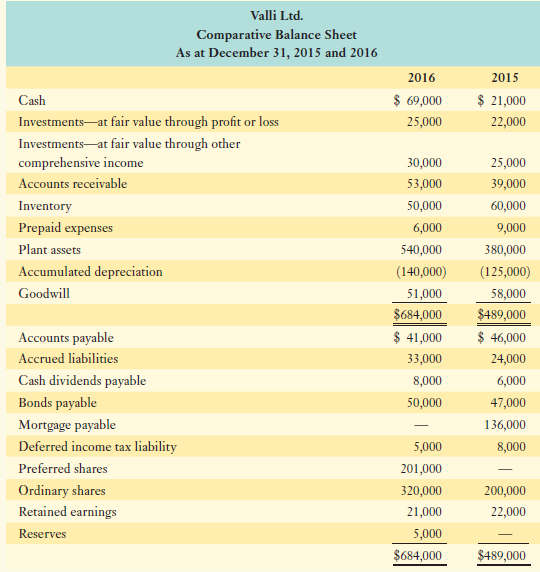

Valli Ltd.s financial statements as at December 31, 2016, appear below: Valli Ltd. Statement of Comprehensive Income

Question:

Valli Ltd.

Statement of Comprehensive Income

For the Year Ended December 31, 2016

Sales ............................................................................................................... $660,000

Cost of sales .................................................................................................. (359,000)

Gross profit ................................................................................................... 301,000

Interest expense, long term ........................................................................ (6,000)

Depreciation expense .................................................................................. (25,000)

Operating expenses ..................................................................................... (160,000)

Other gains and losses ................................................................................ (4,000)

Income before income tax .......................................................................... 106,000

Income tax expense ..................................................................................... (39,000)

Net income .................................................................................................... 67,000

Other comprehensive income: Holding gain on at

fair value through other comprehensive income securities .................... 5,000

Comprehensive income ................................................................................$ 72,000

Supplemental information:

- During the year Valli exchanged 5,000 ordinary shares for plant assets having a fair value of $100,000.

- During the year Valli declared and issued a stock dividend of 1,000 ordinary shares. The transaction was valued at $20,000.

- During the year goodwill was written down $7,000 to reflect a permanent impairment of the asset.

- The deferred income tax liability represents temporary differences relating to the use of capital cost allowance for income tax reporting and straight-line depreciation for financial statement reporting.

- Valli did not buy or sell any at fair value through profit or loss or at fair value through other comprehensive income securities during the year. The at fair value through profit or loss securities have not been designated as cash equivalents.

- The recorded increase in the bonds payable account was due to the amortization of the discount.

- Valli elects to record interest paid as an operating activity and dividends paid as a financing activity.

- During the year Valli sold equipment (plant assets) that originally cost $40,000 for $30,000 cash.

Required:

a. From the information above, prepare Valli€™s statement of cash flows for the year ended December 31, 2016, using the indirect method.

b. Prepare Valli€™s cash flows from operating activities for the year ended December 31, 2016, using the direct method.

c. Prepare note disclosure(s) for non-cash transactions.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: