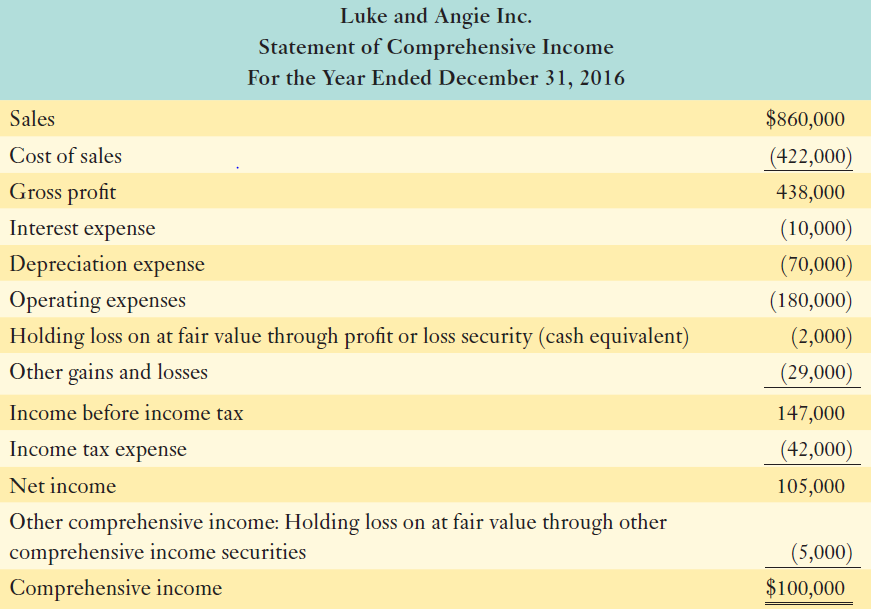

Based on the information presented in PA-48, prepare the cash flows from operating activities section of the

Question:

Data from PA-48

Supplemental financial information for the year ended December 31, 2016:

- Luke and Angie exchanged 1,500 preferred shares for plant assets having a fair value of $150,000.

- Luke and Angie declared and issued 1,000 ordinary shares as a stock dividend valued at $10,000.

- Goodwill was determined to be impaired and was written down $40,000.

- Luke and Angie paid $10,000 cash and signed a finance lease for $90,000 to acquire plant assets with a fair market value of $100,000.

- Luke and Angie sold equipment (plant assets) with a net book value of $70,000 for $80,000 cash.

- Luke and Angie did not buy or sell any at fair value through profit or loss or at fair value through other comprehensive income securities during the year. The at fair value through profit or loss securities have been designated as cash equivalents.

- Financial asset at amortized cost securities with a book value of $10,000 were called for redemption during the year; $11,000 cash was received.

- The recorded decrease in the bonds payable account was due to the amortization of the premium.

- The deferred income tax liability represents temporary differences relating to the use of capital cost allowance for income tax reporting and straight-line depreciation for financial statement reporting.

- Luke and Angie elects to record interest and dividends paid as an operating activity.

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: