When preparing its financial statements at the end of 2022, Thorn Retail Inc. discovered an error in

Question:

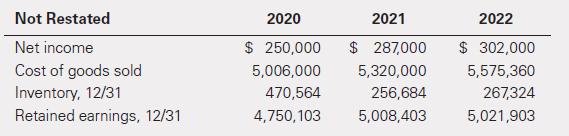

When preparing its financial statements at the end of 2022, Thorn Retail Inc. discovered an error in accounting for inventory. When Thorn started to purchase merchandise from a new supplier, it expensed all transportation costs rather than capitalizing them as a cost of the inventory. It estimated that a portion of the transportation costs was erroneously expensed in 2021 and 2022. Transportation costs were $326,367 and $333,784 in fiscal 2021 and 2022, respectively. The company expensed all of the transportation costs in the year incurred when it should have capitalized a portion of the costs as ending inventory. Thorn determined that 90% of the inventory purchased in 2021 was sold in 2021 and 92% of the inventory purchased in 2022 was sold in 2022. Assume that all inventory on hand at the beginning of the year is sold during the year. Assume no tax implications. Round to the nearest dollar. The information from Thorn’s financial statements before any adjustment follows:

Required

a. Would net income have been higher or lower in 2021 and by how much? What will Thorn report as net income in 2022?

b. What would Thorn report as its inventory and retained earnings balances at the beginning of 2022 and at December 31, 2022?

c. Prepare the retained earnings portion of the statement of stockholders’ equity for 2022.

d. What is the necessary journal entry to record the prior-period adjustment in 2022?

Step by Step Answer:

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella