Winthur Stores began operations on January 1, 2018, and adopted the FIFO method of accounting for its

Question:

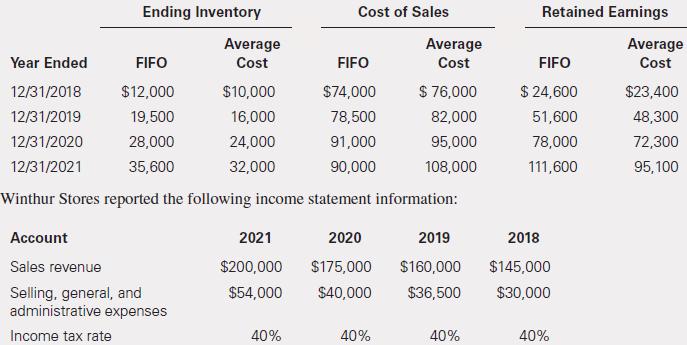

Winthur Stores began operations on January 1, 2018, and adopted the FIFO method of accounting for its inventory for book and tax purposes. In 2021, it is considering a change to the average-cost method basis for book purposes only. Winthur provided the following information to assist in deciding whether to change inventory valuation techniques.

Required

a. Prepare the income statements under both methods for the years ended December 31, 2018, through December 31, 2020.

b. Assume that Winthur Stores changes to the average-cost method effective January 1, 2021. Prepare the comparative income statements for the 3 years ended December 31, 2021.

c. Prepare the retained earnings column of the statement of stockholders’ equity for the year ended December 31, 2021, assuming that Winthur does not present comparative statements. Winthur does not declare dividends in 2018–2021.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella