You are the assistant controller for StrongBar Ltd., a company that specializes in making energy bars and

Question:

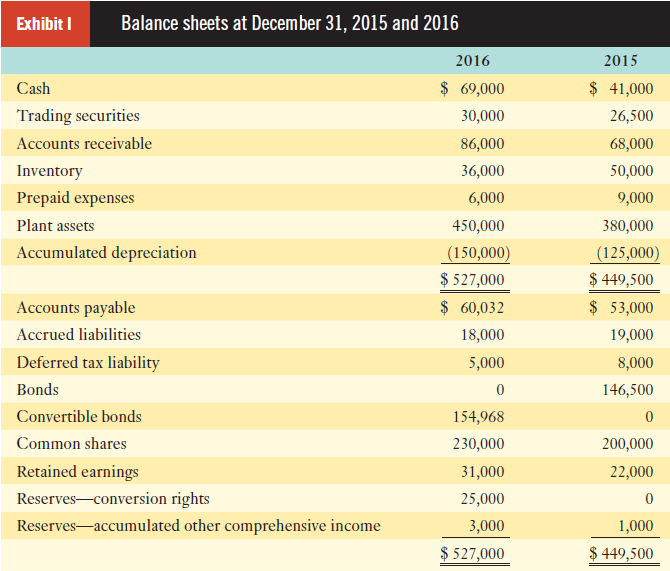

James Well, was supposed to provide her the statement of cash flows, but this morning he called in sick. She is wondering if you can prepare the report for her. She remembers that yesterday Mr. Well started working on the report and suggests that you check his desk for his notes. You tell Ms. Cash that you will try to help her, and promise to update her in few hours. Nervously you walk to Mr. Well€™s office and, searching his desk, you find the following information.

Additional information:

1. In the beginning of 2016 StrongBar had 20,000 shares outstanding.

2. On March 1, the company declared and distributed a 5% stock dividend. At that date StrongBar€™s shares were trading for $10.

3. A cash dividend of $18,000 was declared and paid in October 2016.

4. On May 1, the company issued common shares for cash.

5. On January 1, 2016, StrongBar extinguished all of its outstanding bonds and replaced them with a new issue of convertible bonds. The old bonds had a face value of 150,000. To induce the retirement of the bonds, it offered bondholders $10,000 above the market value of the bonds. At that date the bonds were trading at .99. On the same day StrongBar issued 150,000, 9%, five-year convertible bonds. The bonds pay interest annually on December 31 each year. Similar bonds without conversion options are traded to yield 8%. The company does not remember what the proceeds from the issue were, but the controller€™s notes say that the fair value of the conversion rights at issuance was $25,000. Because the terms of the old bonds and the new bonds were substantially different, those transactions are not considered a modification of debt.

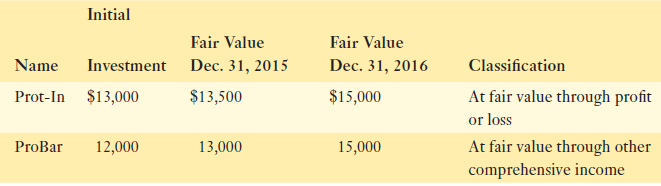

6. StrongBar has two investments, as follows:

7. In 2016 the company sold plant assets with a gross book value of $30,000 and accumulated depreciation of $25,000. There was no gain or loss on the sale.

One thing that you are unable to locate is the income statement or information about the company€™s net income. At first you are worried that this will mean you will not be able to prepare the statement of cash flows. However, after carefully examining the information, you feel relief as you realize that this is not going to be a problem, and you start preparing the report.

StrongBar is a public Canadian company located in Vancouver. StrongBar uses the indirect method for reporting the operating activities section of the statement of cash flows. StrongBar€™s policy is to classify interest expense as an operating activity, dividends paid as a financing activity, and interest and dividends received as investing activities.

Required:

1. Explain how it is possible to prepare the statement of cash flows without having the income statement.

2. Prepare the statement of cash flows. Assume that the bond premium is included in the same category as the underlying interest expense. Ignore the disclosure requirements pertaining to interest and dividends paid and received; income taxes paid; and material non-cash transactions.

3. Now assume that the company classified the dividends paid as an operating activity. Without regenerating the entire report again, explain what will change in the statement of cash flows. Be specific.

4. Suppose investors are unaware that companies can choose how to classify interest expense and dividends paid. How can this affect their assessment of StrongBar€™s statement of cash flows?

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer: