(Analysis of Lease vs. Purchase) Jose Rijo Inc. owns and operates a number of hardware stores in...

Question:

(Analysis of Lease vs. Purchase) Jose Rijo Inc. owns and operates a number of hardware stores in the New England region. Recently the company has decided to locate another store in a rapidly growing area of Maryland. The company is trying to decide whether to purchase or lease the building and related facilities.

Purchase: The company can purchase the site, construct the building, and purchase all store fixtures.

The cost would be $1,650,000. An immediate down payment of $400,000 is required, and the remaining

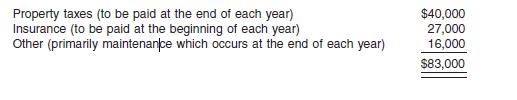

$1,250,000 would be paid off over 5 years at $300,000 per year (including interest). The property is expected to have a useful life of 12 years, and then it will be sold for $500,000. As the owner of the property, the company will have the following out-of-pocket expenses each period.

Lease: First National Bank has agreed to purchase the site, construct the building, and install the appropriate fixtures for Rijo Inc. if Rijo will lease the completed facility for 12 years. The annual costs for the lease would be $240,000. Rijo would have no responsibility related to the facility over the 12 years.

The terms of the lease are that Rijo would be required to make 12 annual payments (the first payment to be made at the time the store opens and then each following year). In addition, a deposit of $100,000 is required when the store is opened. This deposit will be returned at the end of the twelfth year, assuming no unusual damage to the building structure or fixtures.

Currently the cost of funds for Rijo Inc. is 10%.

Instructions Which of the two approaches should Rijo Inc. follow?

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield