(Available-for-Sale SecuritiesStatement Presentation) Alvarez Corp. invested its excess cash in available-for-sale securities during 2006. As of December...

Question:

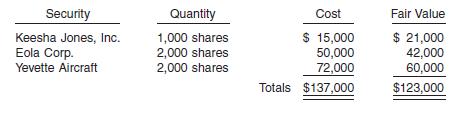

(Available-for-Sale Securities—Statement Presentation) Alvarez Corp. invested its excess cash in available-for-sale securities during 2006. As of December 31, 2006, the portfolio of available-for-sale securities consisted of the following common stocks.

Instructions

(a) What should be reported on Alvarez’s December 31, 2006, balance sheet relative to these securities?

What should be reported on Alvarez’s 2006 income statement?

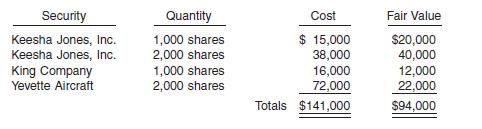

On December 31, 2007, Alvarez’s portfolio of available-for-sale securities consisted of the following common stocks.

During the year 2007, Alvarez Corp. sold 2,000 shares of Eola Corp. for $38,200 and purchased 2,000 more shares of Keesha Jones, Inc. and 1,000 shares of King Company.

(b) What should be reported on Alvarez’s December 31, 2007, balance sheet? What should be reported on Alvarez’s 2007 income statement?

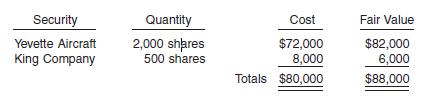

On December 31, 2008, Alvarez’s portfolio of available-for-sale securities consisted of the following common stocks.

During the year 2008, Alvarez Corp. sold 3,000 shares of Keesha Jones, Inc. for $39,900 and 500 shares of King Company at a loss of $2,700.

(c) What should be reported on the face of Alvarez’s December 31, 2008, balance sheet? What should be reported on Alvarez’s 2008 income statement?

(d) What would be reported in a statement of comprehensive income at (1) December 31, 2006, and (2) December 31, 2007?

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield