(Debt Securities) Presented below is an amortization schedule related to Kathy Baker Companys 5-year, $100,000 bond with...

Question:

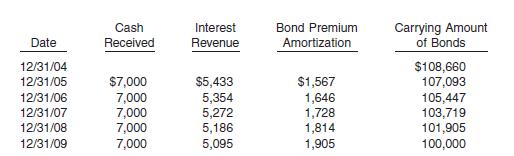

(Debt Securities) Presented below is an amortization schedule related to Kathy Baker Company’s 5-year, $100,000 bond with a 7% interest rate and a 5% yield, purchased on December 31, 2004, for

$108,660.

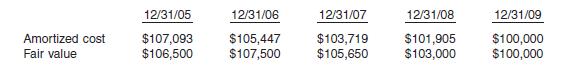

The following schedule presents a comparison of the amortized cost and fair value of the bonds at year-end.

Instructions

(a) Prepare the journal entry to record the purchase of these bonds on December 31, 2004, assuming the bonds are classified as held-to-maturity securities.

(b) Prepare the journal entry(ies) related to the held-to-maturity bonds for 2005.

(c) Prepare the journal entry(ies) related to the held-to-maturity bonds for 2007.

(d) Prepare the journal entry(ies) to record the purchase of these bonds, assuming they are classified as available-for-sale.

(e) Prepare the journal entry(ies) related to the available-for-sale bonds for 2005.

(f) Prepare the journal entry(ies) related to the available-for-sale bonds for 2007.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield