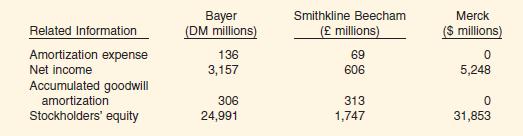

Bayer, Smithkline Beecham, and Merck Presented below are data and accounting policy notes for the goodwill of

Question:

Bayer, Smithkline Beecham, and Merck Presented below are data and accounting policy notes for the goodwill of three international drug companies.

Bayer, a German company, prepares its statements in accordance with International Accounting Standards (IAS); Smithkline Beecham follows United Kingdom (U.K.) rules; and Merck, a U.S. company, prepares its financial statements in accordance with U.S. GAAP.

The following accounting policy notes related to goodwill appeared with the companies’ financial statements.

Bayer Intangible assets that have been acquired are recognized at cost and amortized over their estimated useful lives. Goodwill, including that resulting from capital consolidation, is capitalized in accordance with IAS 22 (Business Combinations) and normally is amortized over a period of 5 or at most 20 years.

Smithkline Beecham Goodwill, representing the excess of the purchase consideration over the fair value of the net separable assets acquired, is capitalised and amortised over an appropriate period not exceeding 20 years.

Merck Goodwill represents the excess of acquisition costs over the fair value of net assets of businesses purchased and is not amortized.

Instructions

(a) Compute the return on equity for each of these companies, and use this analysis to briefly discuss the relative profitability of the three companies.

(b) Assume that each of the companies uses the maximum allowable amortization period for goodwill.

Discuss how these companies’ goodwill amortization policies affect your ability to compare their amortization expense and income.

(c) Some analysts believe that the only valid way to compare companies that follow different goodwill accounting practices is to treat all goodwill as an asset and record expense only if the goodwill is impaired.*

Using the data above, make these adjustments as appropriate, and compare the profitability of the three drug companies, comparing this information to your analysis in (a).

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield