(Bond Theory: Balance Sheet Presentations, Interest Rate, Premium) On January 1, 2008, Branagh Company issued for $1,075,230...

Question:

(Bond Theory: Balance Sheet Presentations, Interest Rate, Premium) On January 1, 2008, Branagh Company issued for $1,075,230 its 20-year, 13% bonds that have a maturity value of $1,000,000 and pay interest semiannually on January 1 and July 1. Bond issue costs were not material in amount.

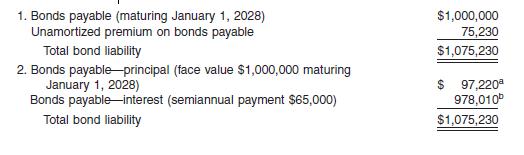

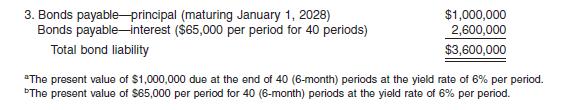

Below are three presentations of the long-term liability section of the balance sheet that might be used for these bonds at the issue date.

Instructions

(a) Discuss the conceptual merit(s) of each of the date-of-issue balance sheet presentations shown above for these bonds.

(b) Explain why investors would pay $1,075,230 for bonds that have a maturity value of only $1,000,000.

(c) Assuming that a discount rate is needed to compute the carrying value of the obligations arising from a bond issue at any date during the life of the bonds, discuss the conceptual merit(s) of using for this purpose:

(1) The coupon or nominal rate.

(2) The effective or yield rate at date of issue.

(d) If the obligations arising from these bonds are to be carried at their present value computed by means of the current market rate of interest, how would the bond valuation at dates subsequent to the date of issue be affected by an increase or a decrease in the market rate of interest?

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield