(Expected Cash Flows and Present Value) At the end of 2003, Richards Company is conducting an impairment...

Question:

(Expected Cash Flows and Present Value) At the end of 2003, Richards Company is conducting an impairment test and needs to develop a fair value estimate for machinery used in its manufacturing operations.

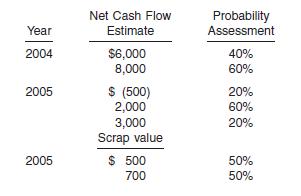

Given the nature of Richard’s production process, the equipment is for special use. (No secondhand market values are available.) The equipment will be obsolete in 2 years, and Richard’s accountants have developed the following cash flow information for the equipment.

Instructions Using expected cash flow and present value techniques, determine the fair value of the machinery at the end of 2003. Use a 6% discount rate. Assume all cash flows occur at the end of the year.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield