Flay Foods has always used the FIFO inventory costing method for both financial reporting and tax purposes.

Question:

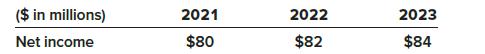

Flay Foods has always used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2024, Flay decided to change to the LIFO method. As a result of the change, net income in 2024 was $80 million. If the company had used LIFO in 2023, its cost of goods sold would have been higher by $6 million that year. Flay’s records of inventory purchases and sales are not available for 2022 and several previous years. Last year, Flay reported the following net income amounts in its comparative income statements:

Required:

1. Prepare the journal entry at the beginning of 2024 to record the change in accounting principle. (Ignore income taxes.)

2. Will Flay apply the LIFO cost method retrospectively or apply the LIFO cost method prospectively?

3. What amounts will Flay report for net income in its 2022–2024 comparative income statements?

Step by Step Answer: