Im so confused, your study partner snarls, throwing up his hands in exasperation. As part of our

Question:

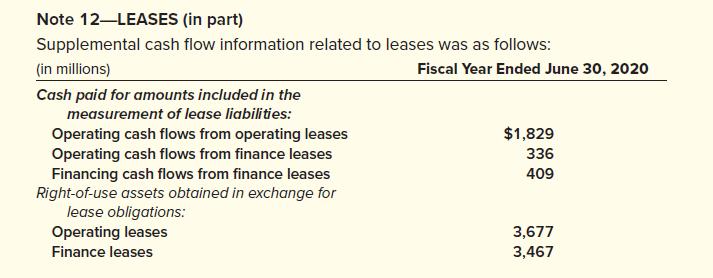

“I’m so confused,” your study partner snarls, throwing up his hands in exasperation. “As part of our team’s group project, I need to find out how much cash Microsoft spent on leases last year, and their statement of cash flows doesn’t even mention leases.” Tossing a sheet of paper in front of you, he mutters, “I found this disclosure note to their financial statements that promises ‘supplemental cash flow information related to leases,’ but it just confuses me more. I think I know the difference between operating leases and finance leases, but why are there operating cash flows for both types, but only financing cash flows for finance leases? And why are new leases listed in connection with cash flows? Did they pay all this cash in addition to incurring lease liabilities for the right-of-use assets? You’re the accounting major; help me out here.” Eager to show off what you learned in Intermediate Accounting, you pick up the disclosure note:

Required:

1. Why are there are operating cash flows for both types of leases, but only financing cash flows for finance leases?

2. To aid in your explanation, prepare a journal entry that summarizes the cash payments for operating leases during the year.

3. To aid in your explanation, prepare a journal entry that summarizes the cash payments for finance leases during the year.

4. Did Microsoft pay the amounts indicated in addition to incurring lease liabilities for the right-of-use assets for finance leases and operating leases? Why or why not?

5. To aid in your explanation, prepare a journal entry that summarizes the acquisition of assets by operating leases during the year.

Step by Step Answer: