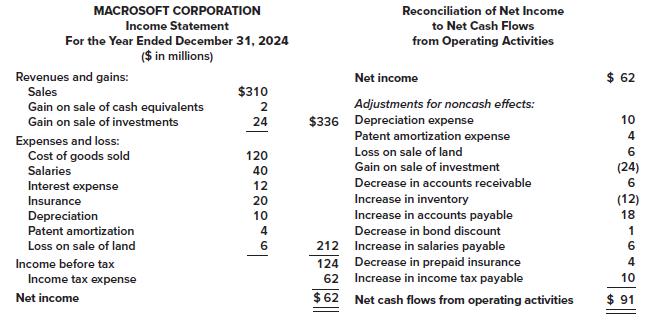

The income statement and a schedule reconciling cash flows from operating activities to net income are provided

Question:

The income statement and a schedule reconciling cash flows from operating activities to net income are provided below for Macrosoft Corporation.

Required:

Prepare the cash flows from operating activities section of the statement of cash flows (direct method).

Transcribed Image Text:

MACROSOFT CORPORATION Income Statement For the Year Ended December 31, 2024 ($ in millions) Revenues and gains: Sales Gain on sale of cash equivalents Gain on sale of investments Expenses and loss: Cost of goods sold Salaries Interest expense Insurance Depreciation Patent amortization Loss on sale of land Income before tax Income tax expense Net income $310 2 24 120 40 12 20 10 4 6 Reconciliation of Net Income to Net Cash Flows from Operating Activities 212 124 62 $62 Net income Adjustments for noncash effects: $336 Depreciation expense Patent amortization expense Loss on sale of land Gain on sale of investment Decrease in accounts receivable Increase in inventory Increase in accounts payable Decrease in bond discount Increase in salaries payable Decrease in prepaid insurance Increase in income tax payable Net cash flows from operating activities $ 62 10 4 6 (24) 6 (12) 18 1 6 4 10 $91

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

Cash Flows from Operating Activities Cash received from customers 316 a Cash increase from sale of cash equivalents 2 b Cash paid to suppliers 114 c C...View the full answer

Answered By

Kalyan M. Ranwa

I have more than seven years of teaching experience in physics and mechanical engineering.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The income statement and a schedule reconciling cash flows from operating activities to net income are provided below for Macro Soft Corporation. Required: Prepare the cash flows from operating...

-

The income statement and a schedule reconciling cash flows from operating activities to net income are provided below ($ in thousands) for Peach Computers. Required: 1. Calculate each of the...

-

The income statement and a schedule reconciling cash flows from operating activities to net income are provided below for Mike Roe Computers. Required: 1. Calculate each of the following amounts for...

-

6- Where is "bunds Payable" account recorded in the balance sheet? A)Long Term Liabilities B) Non Current Assets C) Current Assets D) Owner's Equity

-

Explain which portions of the material previously discussed in this text are reflected in the three equations DSGE model discussed at the end of this chapter. What kind of a shock to this simple...

-

Fortune magazine (March 1997) reported the total returns to investors for the 10 years prior to 1996 and also for 1996 for 431 companies. The total returns for 9 of the companies and the S&P 500 are...

-

What are some of the unique characteristics of derivatives?

-

George Zegoyan and Amir Gupta face a difficult decision. Their private auto parts manufacturing company has been a great success - too quickly. They cannot keep up with the demand for their product....

-

Required information Problem 18-45 (Static) (LO 18-1, 18-2, 18-4, 18-5, 18-8) Skip to question [The following information applies to the questions displayed below.] For a number of years, a private...

-

Honolulu Shirt Shop has very seasonal sales. Assume that for next year management is trying to decide whether to establish a sales budget based on average sales or on sales estimated by quarter. The...

-

Refer to the situation described in BE 215. What would be the amount(s) related to the bonds that Agee would report in its statement of cash flows for the year ended December 31, 2024, if it uses the...

-

Im so confused, your study partner snarls, throwing up his hands in exasperation. As part of our teams group project, I need to find out how much cash Microsoft spent on leases last year, and their...

-

If Valdamorte Company had net income of $560,000 in 2014 and it experienced a 40% increase in net income over 2013, what was its 2013 net income?

-

A Ltd. is preparing its cash budget for the period. Sales are expected to be ` 1,00,000 in April 2015, `2,00,000 in May 2015, ` 3,00,000 in June 2015 and ` 1,00,000 in July 2015. Half of all sales...

-

A Company Operates throughput accounting system. The details of product A per unit are as under: Selling price `40 Material Cost `10 Conversion Cost `15 Time on Bottleneck resources 10 minutes What...

-

Show that the graph of an equation of the form Ax 2 + Dx + Ey + F = 0, A 0, (a) Is parabola if E 0. (b) Is a vertical line if E = 0 and D 2 - 4AF = 0. (c) Is two vertical lines if E = 0 and D 2 -...

-

(a) Use integration by parts to show that (b) If f and g are inverse functions and f' is continuous, prove that (c) In the case where f and t are positive functions and b > a > 0, draw a diagram to...

-

The following questions are used in the Kaplan CPA Review Course to study long-term liabilities while preparing for the CPA examination. Determine the response that best completes the statements or...

-

The following questions dealing with long-term liabilities are adapted from questions that previously appeared on Certified Management Accountant (CMA) examinations. The CMA designation sponsored by...

-

On January 1, 2011, Instaform, Inc., issued 10% bonds with a face amount of $50 million, dated January 1. The bonds mature in 2030 (20 years). The market yield for bonds of similar risk and maturity...

-

The market price of a stock is $24.55 and it is expected to pay a dividend of $1.44 next year. The required rate of return is 11.23%. What is the expected growth rate of the dividend? Submit Answer...

-

Suppose Universal Forests current stock price is $59.00 and it is likely to pay a $0.57 dividend next year. Since analysts estimate Universal Forest will have a 13.8 percent growth rate, what is its...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

Study smarter with the SolutionInn App