Kellogg Corporation is the worlds leading producer of ready-to-eat cereal products. In recent years the company has

Question:

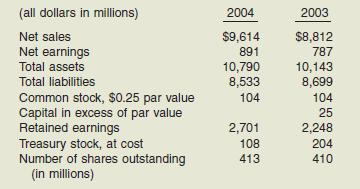

Kellogg Corporation is the world’s leading producer of ready-to-eat cereal products. In recent years the company has taken numerous steps aimed at improving its profitability and earnings per share. Presented below are some basic facts for Kellogg Corporation

Instructions

(a) What are some of the reasons that management purchases its own stock?

(b) Explain how earnings per share might be affected by treasury stock transactions.

(c) Calculate the ratio of debt to total assets for 2003 and 2004, and discuss the implications of the change.

Case 2: Wiebold, Incorporated The following note related to stockholders’ equity was reported in Wiebold, Inc.’s annual report.

On February 1, the Board of Directors declared a 3-for-2 stock split, distributed on February 22 to shareholders of record on February 10. Accordingly, all numbers of common shares, except unissued shares and treasury shares, and all per share data have been restated to reflect this stock split.

On the basis of amounts declared and paid, the annualized quarterly dividends per share were $0.80 in the current year and $0.75 in the prior year.

Instructions

(a) What is the significance of the date of record and the date of distribution?

(b) Why might Weibold have declared a 3-for-2 for stock split?

(c) What impact does Wiebold’s stock split have on (1) total stockholders’ equity, (2) total par value, (3)

outstanding shares, and (4) book value per share?

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield