S&J Lawn Service Company maintains its books on a cash basis. However, the company recently borrowed $100,000

Question:

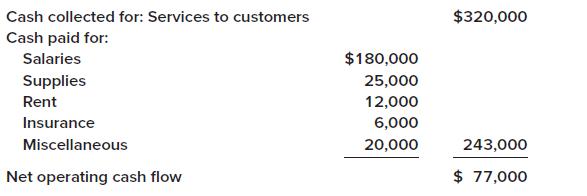

S&J Lawn Service Company maintains its books on a cash basis. However, the company recently borrowed $100,000 from a local bank, and the bank requires S&J to provide annual financial statements prepared on an accrual basis. During 2024, the following cash flows were recorded:

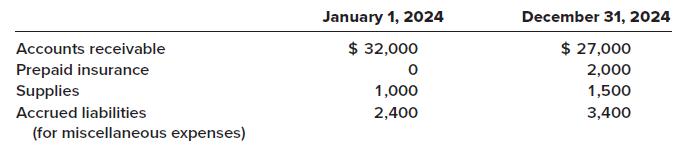

You are able to determine the following information about accounts receivable, prepaid expenses, and accrued liabilities:

In addition, you learn that the bank loan was dated September 30, 2024, with principal and interest at 6% due in one year. Depreciation on the company’s equipment is $10,000 for the year.

Required:

Prepare an accrual basis income statement for 2024. (Ignore income taxes.)

Transcribed Image Text:

Cash collected for: Services to customers Cash paid for: Salaries Supplies Rent Insurance Miscellaneous Net operating cash flow $180,000 25,000 12,000 6,000 20,000 $320,000 243,000 $ 77,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 64% (17 reviews)

SJ Lawn Service Company Income Statement For the Year Ended December 31 2024 Service revenue 1 Opera...View the full answer

Answered By

Nicole omwa

Being a highly skilled tutor with at least 5 years of tutoring experience in different areas, I learned how to help diverse learners in writing drafts of research papers, actual research papers and locate credible sources. My assurance is built upon my varied knowledge of a variety of subjects. Furthermore, my involvement and interaction with numerous learners of all levels has allowed me to understand my clients' specific demands. Ultimately, this has aided me in being a better coach to learners to better their grades. Essentially, my responsibilities as a tutor would include:

Teaching abilities that assist pupils in enhancing their academic performance

Personal interaction with learners to make them understand abstract concepts

Inducing new skills and knowledge into their academic journeys

Fostering individual reflection, and independent and critical thinking

Editing and proofreading

Because I am constantly available to respond to your queries, you may decide to rely on me whenever you require my assistance. As an assurance, my knowledge skills and expertise enable me to quickly assist learners with different academic challenges in areas with difficulty in understanding. Ultimately, I believe that I am a reliable tutor concerned about my learner's needs and interests to solve their urgent projects. My purpose is always to assist them in comprehending abstract schoolwork and mastering their subjects. I also understand that plagiarism is a severe offense and has serious ramifications. Owing to this, I always make it a point to educate learners on the numerous strategies to have uniquely unique solutions. I am familiar with the following formatting styles:

MLA

APA

Harvard

Chicago

IEEE

Communication is always the key in every interaction with my learners. Hence, I provide timely communication about the progress of assigned projects. As a result, I make sure that I maintain excellent communication with all of my clients. I can engage with all of my customers more effectively, assisting them with their unique academic demands. Furthermore, I attempt to establish a solid working relationship with my leaners I have exceptional abilities in the below areas;

Sociology

History

Nursing

Psychology

Literature

Health and Medicine

Chemistry

Biology

Management

Marketing

Business

Earth Science

Environmental Studies

Education

Being a teacher who aces in diverse fields, I provide various academic tasks, which include;

Academic Reports

Movie Reviews

Literature Reviews

Annotated bibliographies

Lab reports

Discussion posts

Dissertations

Case study analyses

Research proposals

Argumentative Essays

I guarantee you high-quality Papers!!!!!

5.00+

17+ Reviews

32+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Haskins and Jones, Attorneys-at-Law, maintains its books on a cash basis. During 2021, the law firm collected $545,000 for services rendered to its clients and paid out $412,000 in expenses. You are...

-

A foreign company maintains its books and records in its domestic currency. Identify several factors that might suggest that the domestic currency is not the entitys functional currency.

-

Haskins and Jones, Attorneys-at-Law, maintain its books on a cash basis. During 2018, the company collected $545,000 in fees from its clients and paid out $412,000 in expenses. You are able to...

-

Which of these statements is false? A. Assets = Liabilities + Equity B. Assets Liabilities = Equity C. Liabilities Equity = Assets D. Liabilities = Assets Equity

-

In Chapter 6, Exercise 41 we examined the relationship between the fuel economy (mpg) and Engine Size for 35 models of cars (Data in Fuel Economy 2014). Further analysis produces the regression model...

-

Refer to Exhibit 1-1, and give an example of a purchase you made recently that involved separation of information and separation in time between you and the producer. Briefly explain how these...

-

1 What does the case so far suggest about the management issues it will face in operating internationally?

-

In the Camry focus group analysis in this chapter, we used a regression to estimate the demand for Camrys. Using that equation, how many fewer Camrys would the focus group buy if the price were...

-

Jamesway Corporation makes two types of replacement fittings for heavy construction equipment-screws and bolts. Data regarding the two products follow: Direct Labour- Hours per Unit 0.20 0.10 Screws...

-

In SCTP, the following is a dump of a DATA chunk in hexadecimal format. 00000015 00000005 0003000A 00000000 48656C6C 6F000000 a. Is this an ordered or unordered chunk? b. Is this the first, the last,...

-

Haskins and Jones, Attorneys-at-Law, maintains its books on a cash basis. During 2024, the law firm collected $545,000 for services rendered to its clients and paid out $412,000 in expenses. You are...

-

During the course of your examination of the financial statements of the Hales Corporation for the year ended December 31, 2024, you discover net income in 2024 is $30,000 but no adjusting entries...

-

What role does the self-reference criterion play in international business ethics?

-

Consider the project information in the table below: Draw and analyze a project network diagram to answer the following questions: a. If you were to start on this project, which are the activities...

-

Lacey, Inc., had the following sales and purchase transactions during 2011. Beginning inventory consisted of 80 items at \(\$ 120\) each. Lacey uses the FIFO cost flow assumption and keeps perpetual...

-

Refer to the Camp Sunshine data presented in E5-9. Required: 1. Perform a least-squares regression analysis on Camp Sunshines data. 2. Using the regression output, create a cost equation (Y = A + BX)...

-

The following information pertains to the first year of operation for Sonic Boom Radios, Inc. Required: Prepare Sonic Booms full absorption costing income statement and variable costing income...

-

Jane Crawford, the president of Crawford Enterprises, is considering two investment opportunities. Because of limited resources, she will be able to invest in only one of them. Project A is to...

-

What is the coefficient of variation? How is it used as a measure of risk?

-

a. Show that the expansion of q(x) in ascending powers of x can be approximated to 10 2x + Bx 2 + Cx 3 where B and C are constants to be found. b. Find the percentage error made in using the series...

-

Identify two important variables to be considered when making an investment decision.

-

What must a company do in the long run to be able to provide a return to investors and creditors?

-

What must a company do in the long run to be able to provide a return to investors and creditors?

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

Study smarter with the SolutionInn App