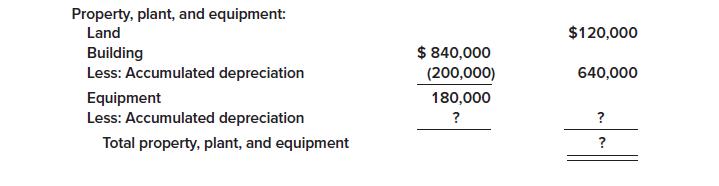

The property, plant, and equipment section of the Jasper Companys December 31, 2023, balance sheet contained the

Question:

The property, plant, and equipment section of the Jasper Company’s December 31, 2023, balance sheet contained the following:

The land and building were purchased at the beginning of 2019. Straight-line depreciation is used and a residual value of $40,000 for the building is anticipated.

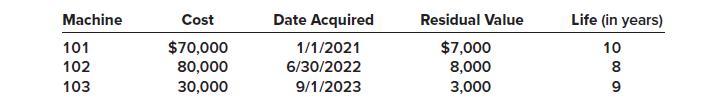

The equipment is comprised of the following three machines:

The straight-line method is used to determine depreciation on the equipment. On March 31, 2024, Machine 102 was sold for $52,500. Early in 2024, the useful life of machine 101 was revised to seven years in total, and the residual value was revised to zero.

Required:

1. Calculate the accumulated depreciation on the equipment at December 31, 2023.

2. Prepare the journal entry to record 2024 depreciation on machine 102 up to the date of sale.

3. Prepare a schedule to calculate the gain or loss on the sale of machine 102.

4. Prepare the journal entry for the sale of machine 102.

5. Prepare the 2024 year-end journal entries to record depreciation on the building and remaining equipment.

Step by Step Answer: