(Various Reporting Formats) The following information was taken from the records of Roland Carlson Inc. for the...

Question:

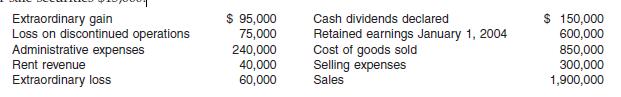

(Various Reporting Formats) The following information was taken from the records of Roland Carlson Inc. for the year 2004. Income tax applicable to income from continuing operations $187,000;

income tax applicable to loss on discontinued operations $25,500; income tax applicable to extraordinary gain $32,300; income tax applicable to extraordinary loss $20,400; and unrealized holding gain on availablefor-

sale securities $15,000.

Shares outstanding during 2004 were 100,000.

Instructions

(a) Prepare a single-step income statement for 2004.

(b) Prepare a retained earnings statement for 2004.

(c) Show how comprehensive income is reported using the second income statement format

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield