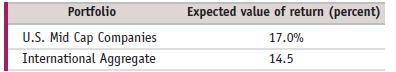

1.11. U.S. Mid Cap Companies and International Aggregate are two portfolios constructed from U.S. and international stocks,...

Question:

1.11. U.S. Mid Cap Companies and International Aggregate are two portfolios constructed from U.S. and international stocks, respectively. The accompanying table shows historical data from the period 1975–2006, which suggest the expected value of the annual percentage returns associated with these portfolios.

a. Which portfolio would a risk-neutral investor prefer?

b. Juan, a risk-averse investor, chooses to invest in the International Aggregate portfolio. What can be inferred about the risk of the two portfolios from Juan’s choice of investment? Based on historical performance, would a risk-neutral investor ever choose International Aggregate?

c. Juan is aware that diversification can reduce risk. He considers a portfolio in which half his investment is in U.S.

companies and the other half in international companies.

What is the expected value of the return for this combined portfolio? Would you expect this combined portfolio to be more risky or less risky than the International Aggregate portfolio? Why or why not?

Step by Step Answer: