13. Suppose you conduct currency carry trade by borrowing $1,000,000 at the start of each year and...

Question:

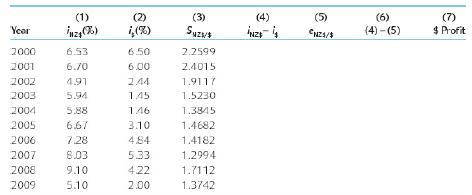

13. Suppose you conduct currency carry trade by borrowing $1,000,000 at the start of each year and investing in the New Zealand dollar for one year. One-year interest rates and the exchange rate between the U.S. dollar ($) and New Zealand dollar (NZ$) are provided below for the period 2000–2009. Note that interest rates are one-year interbank rates on January 1 each year, and that the exchange rate is the amount of New Zealand dollar per U.S. dollar on December 31 each year. The exchange rate was NZ$1.9088/$ on January 1, 2000. Fill out columns 4–7 and compute the total dollar profit from this carry trade over the ten-year period. Also, assess the validity of uncovered interest rate parity based on your solution of this problem. You are encouraged to use the Excel spreadsheet software to tackle this problem.

Step by Step Answer:

ISE International Financial Management

ISBN: 9781260575316

9th International Edition

Authors: Cheol Eun, Bruce Resnick, Tuugi Chuluun