A stockbroker expects XSTREME plc to pay the following annual euro dividend per share during the next

Question:

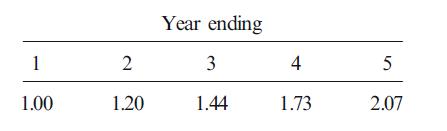

A stockbroker expects XSTREME plc to pay the following annual euro dividend per share during the next five years.

The broker wants to estimate the value per share for comparison with the current market price. If the value compares favorably with the current price, he will consider recommending purchase of the shares to his clients.

To calculate the value per share, he needs to estimate the price per share at the end of Year 5. The Year-5 price, however, depends upon expected dividends beyond that date. He expects a 7% compound rate of growth for the dividends beyond Year 5. He thinks that the discount rate for all dividends should be 12%.

Estimate the Year 5 price and the Year 0 value per share.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: