APVAL PLC is negotiating a bank loan to help fund the following project: The company usually aims

Question:

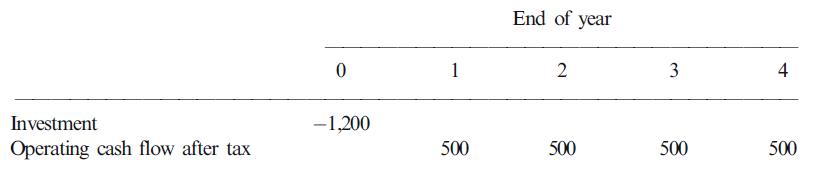

APVAL PLC is negotiating a bank loan to help fund the following project:

The company usually aims to borrow half the funds required for projects. The company’s treasurer expects to pay 8% on all new borrowing during the next four years. She also expects the company to pay corporate taxes at 30%. Consistent with 50% debt financing, she expects the cost of equity for the project will be 12%.

Use the WACC method to estimate the PV of the tax benefit from borrowing to finance half the cost of this project. Assume the company will continue to pay corporate taxes during the next four years.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: