Because of a possible merger with a company having accumulated losses, APVAL could find itself in a

Question:

Because of a possible merger with a company having accumulated losses, APVAL could find itself in a non-tax paying position for the next two years, however. The implication is that the company would not get the benefit of deducting interest payments from taxable income until Year 3. The company can carry forward its accumulated tax deductions to that year, however.

Using the APV method, estimate the PV of the tax benefit of the bank loan in Problem 2 if APVAL will not be paying taxes until Year 3.

Data From Problem 2:-

The bank proposes to lend the company €600,000 toward the €1.2 million required to invest in the project in Problem 1. The rate of interest would be 8%. The loan is repayable in three equal annual instalments, the first paid at the end of the first year.

Use the APV method to calculate the PV of the tax benefit of the loan if the company continues to pay taxes during the next four years.

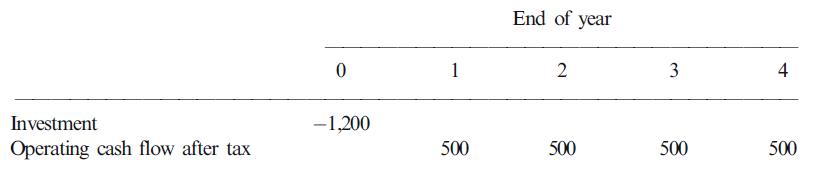

Data From Problem 1:-

APVAL PLC is negotiating a bank loan to help fund the following project:

The company usually aims to borrow half the funds required for projects. The company’s treasurer expects to pay 8% on all new borrowing during the next four years. She also expects the company to pay corporate taxes at 30%. Consistent with 50% debt financing, she expects the cost of equity for the project will be 12%.

Use the WACC method to estimate the PV of the tax benefit from borrowing to finance half the cost of this project. Assume the company will continue to pay corporate taxes during the next four years.

Step by Step Answer: