BIOTEK SA is developing a genetically engineered drug. Tests indicate that the drug can almost certainly arrest

Question:

BIOTEK SA is developing a genetically engineered drug. Tests indicate that the drug can almost certainly arrest particular types of cancer. Before the drug can become a marketable product, however, it must go through a long process of clinical testing and government approval. The time expected to complete this process is 10 years.

Ten years from now the NPV might turn out to be very much greater than zero, however, or it could be less. If the NPV should be negative at that time, nothing obliges the company to launch the product. If the NPV should be positive instead, BIOTEK will invest in the product. An expected total investment of €2 billion (€2,000 million) in manufacturing capacity, advertising, and distribution will be required.

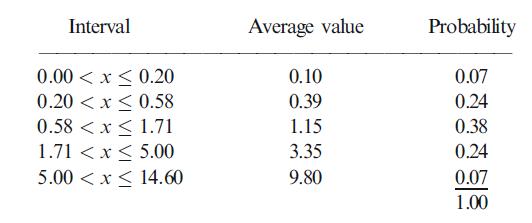

The spread of possible PI values will be quite wide. After contemplating a number of market scenarios, management estimated the following table for the PI.

BIOTEK’s discount rate for the project’s PV is 15%. Its discount rate for the expected €2,000 million investment is 10%.

(a) What is the PV now of the real option to launch this new drug?

(b) How much money (in PV) can the company plan to spend on clinical testing and approval without losing value for shareholders?

Step by Step Answer: