If HARDWARE PLC invests now in the Alpha Project, the NPV would be 45,000. If the company

Question:

If HARDWARE PLC invests now in the Alpha Project, the NPV would be €45,000. If the company delays investing in the project for one year instead, the expected NPV at that time would be €50,000. The expected required investment one year from now is

€300,000. Therefore, the expected PV at that time is €350,000. The discount rate for the PV is 12%. Unfortunately, the PV of the after-tax income lost during the one-year delay would be €85,000.

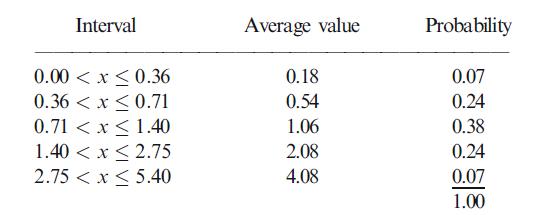

Management’s estimated histogram for the PI reflects a significant spread, however, as seen in the table below.

Management intends to use a discount rate equal to only 9% for the expected investment.

(a) What is the NPV now of the real option to invest in the Alpha Project next year?

(b) What would be the minimum required NPV from the Alpha Project to justify investment right away? Should the company delay investing in the project?

Step by Step Answer: