HARDWARE PLC is considering how much to charge for the extra benefit customers would derive from incorporation

Question:

HARDWARE PLC is considering how much to charge for the extra benefit customers would derive from incorporation of reconfigurable microprocessor chips in the company’s Gamma Product. Reconfiguration permits a customer to change the design of an existing chip for new requirements. Therefore, the chips give customers a valuable real option to change technology. The customer benefits by saving the cost of replacing chips and of installing them.

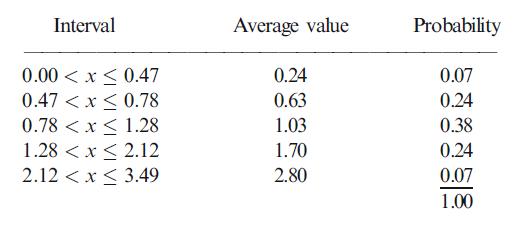

HARDWARE’s financial analyst estimates that customers will need to reconfigure about once a year. The analyst expects that the cost of a replacement chip and installing it would be €80 on average, but the spread of possible replacement costs is not small. One of HARDWARE’s analysts produced the following table of rough estimates for the PI for replacement. The discount rate for the cost of a replacement is 15%.

The cost to the customer of each reconfiguration is €60. The discount rate for the cost of reconfiguring the microprocessor is 8%.

(a) What is the PV now of the real option to reconfigure the microprocessor after one year?

(b) Assuming that customers will have just one opportunity to reconfigure, what is the most that HARDWARE PLC can justify charging for the reconfigurable chips if reconfiguration occurs just once after one year?

(c) Say how you would solve the problem in

(b) if customers will have three annual opportunities to reconfigure the chip instead of just one.

Step by Step Answer: