The industrial engineers at HARDWARE PLC are designing a new factory building. By altering the design, they

Question:

The industrial engineers at HARDWARE PLC are designing a new factory building. By altering the design, they can make it feasible to sell the building in the future. The design change would increase its initial cost. The company will require the building for at least five years, however. The question is what is the justifiable upper limit on the cost of the building if it is to be attractive to potential buyers.

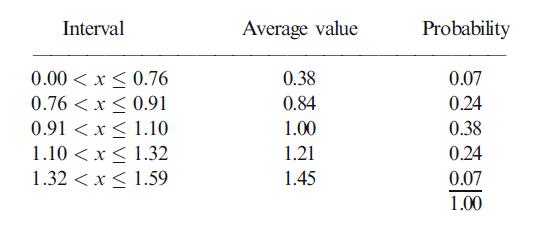

The industrial engineers expect that the value of the altered building in five years’ time should be worth around €10 million to the company. The discount rate for this would be only 6%. The expected market price for the altered building is also €10 million, but the actual price could deviate widely from this figure. The following table represents the estimated distribution of probabilities for the PI for selling the building in five years’ time.

The discount rate for the market price is 14%.

(a) What is the PV now of the real option to sell the building in five years’ time?

(b) How much more can HARDWARE afford to spend on the building now to make it attractive to potential buyers in five years’ time?

Step by Step Answer: