Brenda is considering an investment in the ordinary shares of either Baker plc or Grant plc. Both

Question:

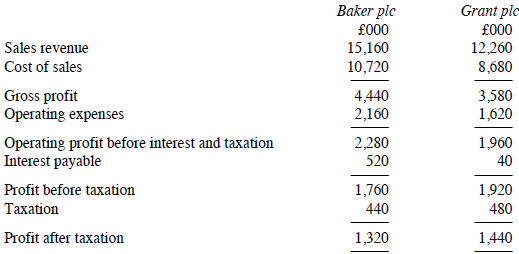

Statements of comprehensive income for the year to 30 September 2018.

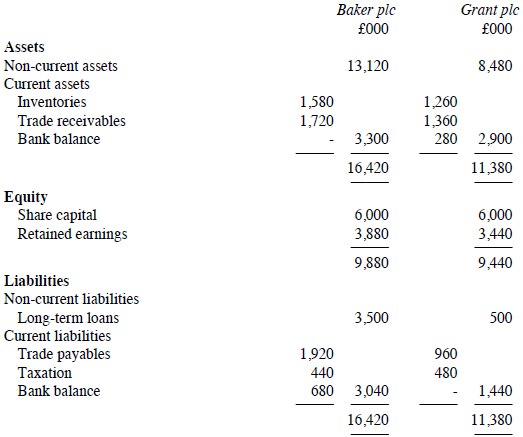

Statements of financial position as at 30 September 2018.

The following information is also available:

1. For both companies, all purchases and sales are made on credit terms.

2. During the year to 30 September 2018, Baker plc paid dividends of £180,000 and Grant plc paid dividends of £600,000.

3. Each company's issued share capital consists of 6 million ordinary shares of £1 each. At the close of business on 30 September 2018, the market price of an ordinary share in Baker plc was £1.65 and the market price of an ordinary share in Grant plc was £2.40.

Having examined the financial statements of the two companies, Brenda is inclined to invest in the shares of Baker plc. Her reasons for this view are that Baker plc has higher turnover, higher operating profit and greater assets than Grant plc. The shares of Baker plc are also cheaper.

Required:

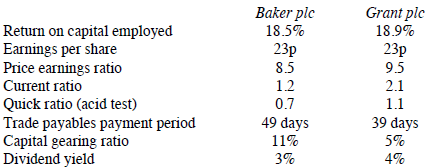

(a) In so far as the information given permits, compute the following ratios for Baker plc and Grant plc:

- Return on capital employed.

- Earnings per share.

- Price earnings ratio.

- Current ratio.

- Quick ratio (acid test).

- Trade payables payment period.

- Capital gearing ratio.

- Dividend yield.

(b) Ratios for the two companies based upon the financial statements for the previous year (i.e. the year to 30 September 2017) were as follows:

Taking into account these ratios and those which you have calculated for the year to 30 September 2018, advise Brenda which of the two companies seems to be the better investment. Give reasons for your advice.

(c) Identify three types of further information which should be obtained before a final investment decision is made.

(CIPFA)

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville