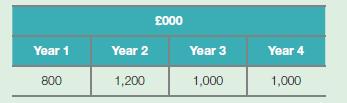

FDI valuation. XH plc is considering the following cash flows for project Y (mining rare earth) in

Question:

FDI valuation. XH plc is considering the following cash flows for project Y (mining rare earth) in country K that requires an initial investment of £2.5 million.

a Calculate the NPV using the companies weighted average cost of capital of 12 per cent – is the project worth undertaking?

b A director points out that as the investment is in a country that is relatively unstable, a more appropriate discount rate would be 25 per cent.

Recalculate the NPV at 25 per cent and reconsider your answer to part (a).

c A second director argues that the risk is in fact about whether or not a licence will be granted to mine rare earth. If it is not granted then XH plc can withdraw immediately with a loss of about £300,000. Reconsider your answer to the first two parts of this question.

d A third director points out that should XH not go ahead, a local mining company CC will almost certainly put in for a licence and is likely to collaborate with a rival US company. Other deposits are thought to be present.

Reconsider your previous answers.

e Identify the real option and game theoretic (competitive) elements of this question.

Step by Step Answer: