INTERNATIONALs analyst believes that compound growth models overvalue companies. She prefers linear growth models, which give more

Question:

INTERNATIONAL’s analyst believes that compound growth models overvalue companies.

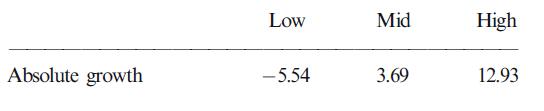

She prefers linear growth models, which give more conservative valuations. IPCO’s free cash flow for the current year is 39.63. Her range of estimates for the absolute amounts of additional cash flow in each year is:

The value of IPCO’s debt is 100. The analyst considers 20% to be the appropriate discount rate in this calculation for IPCO.

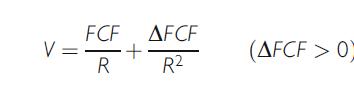

(a) Use these data in the linear growth model to obtain values for the company and for its equity if its debt equals 100. The equation for the linear growth model in this application is:

(b) Explain why you were unable to obtain more than two values for the company using these data.

(c) Is there justification for feeling more confident about using initial absolute increments of growth in the linear model rather than using the corresponding initial percentage growth rates in the compound growth model (Problem 3)?

Step by Step Answer: