The third method INTERNATIONALs analyst wants to use for valuing IPCOis discounted free cash flow. Her range

Question:

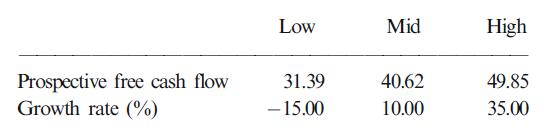

The third method INTERNATIONAL’s analyst wants to use for valuing IPCOis discounted free cash flow. Her range of estimates for the coming year’s free cash flow and for the corresponding initial growth rates are:

The value of IPCO’s debt is 100. The analyst considers 20% to be the appropriate discount rate in this calculation for IPCO.

(a) Use this data in the Gordon–Williams compound growth model to obtain values for the company and for its equity.

(b) Explain why you were unable to obtain more than two values for the company using these data.

(c) What reservations have you about using initial growth rate data in a compound growth valuation model?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: