The financial analyst at INTERNATIONAL wants to continue her valuation of IPCO using some additional valuation methods.

Question:

The financial analyst at INTERNATIONAL wants to continue her valuation of IPCO using some additional valuation methods. The second is the prospective P/S method. The prospective P/S ratio she uses for a company is its total market value divided by the analysts’ consensus for its sales in the following year. The total market value in the numerator of the ratio is the market value of the company’s equity plus the value of its debt.

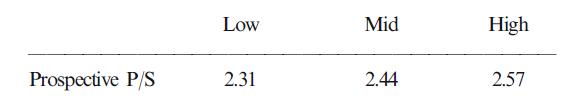

She needs to have a range of suitable P/S values for the valuation. So, her first step was to collect a sample of prospective P/Ss for companies already trading in the stock market.

She found that most of the prospective P/Ss fell in the following range:

The company’s debt is 100. Show how the analyst can obtain nine values for IPCO’s equity using the above information and data selected from Problem 1.

Step by Step Answer: