On 1 October 2017 Pumice acquired the following non-current investments: (i) 80% of the equity share capital

Question:

(i) 80% of the equity share capital of Silverton at a cost of £13.6 million.

(ii) 50% of Silverton's 10% loan notes at par.

(iii) 1.6 million equity shares in Amok at a cost of £6.25 each.

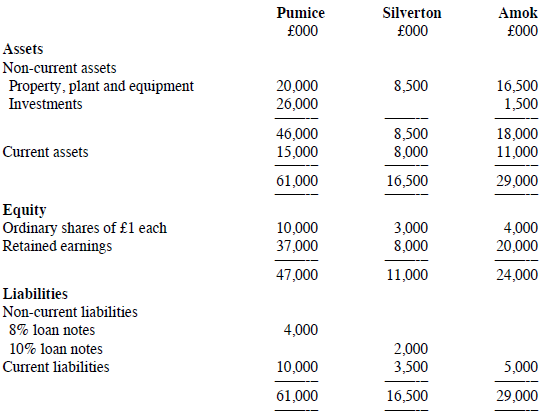

Draft statements of financial position of the three companies at 31 March 2018 are:

The following information is relevant:

(i) The fair values of Silverton's assets were equal to their carrying amounts with the exception of land and plant. Silverton's land had a fair value of £400,000 in excess of its carrying amount and plant had a fair value of £1.6 million in excess of its carrying amount. The plant had a remaining life of four years (straight-line depreciation) at the date of acquisition.

(ii) In the post-acquisition period, Pumice sold goods to Silverton at a price of £6 million. These goods had cost Pumice £4 million. Half of these goods were still in the inventory of Silverton at 31 March 2018. Silverton had a balance of £1.5 million owing to Pumice at 31 March 2018 which agreed with Pumice's records.

(iii) The net profit after tax for the year ended 31 March 2018 was £2 million for Silverton and £8 million for Amok. Assume profits accrued evenly throughout the year.

(iv) An impairment test at 31 March 2018 concluded that consolidated goodwill was impaired by £400,000 and the investment in Amok was impaired by £200,000.

(v) No dividends were paid during the year by any of the companies.

(vi) Non-controlling interests in subsidiaries are to be measured at the appropriate. Proportion of the subsidiary's identifiable net assets.

Required:

(a) Explain how the investments purchased by Pumice on 1 October 2017 should be treated in its consolidated financial statements.

(b) Prepare the consolidated statement of financial position for Pumice as at 31 March 2018.

(ACCA)

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Step by Step Answer:

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville