SDF plc sells a futures contract on Klankian dollars (KAD) with eight days to go before maturity

Question:

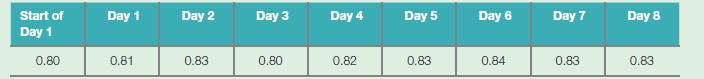

SDF plc sells a futures contract on Klankian dollars (KAD) with eight days to go before maturity for KADGBP 0.80.

The closing prices over those eight days is as follows:

a Explain why daily settlement is required and calculate the daily settlements for SDF.

b Explain why the contract itself is very cheap.

c Illustrate the effect of a default by the counterparty.

d SDF let the futures run to maturity. Explain the difficulties that this may have caused.

e Explain why letting commodity futures run to maturity is a very bad policy.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: