FGH plc buys a futures contract on the Chicago Mercantile Exchange (CME) for country Klankia dollars (KAD)

Question:

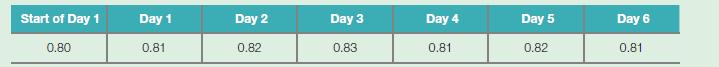

FGH plc buys a futures contract on the Chicago Mercantile Exchange (CME) for country Klankia dollars (KAD) with six days to go until maturity for KADGBP 0.80, the spot rate is KADGBP 0.77. Over the six days the closing price of the futures is as follows:

a Calculate the daily settlement per dollar and per contract.

b At the end of Day 2 the clearing house informs you that the counterparty has defaulted but that it does not affect your contract in any way. Explain why this is so. (Hint: show the payments and receipts for the relevant parties for the whole of the contract.)

c FGH closes out at the end of Day 5. What does this mean and why has FGH done this?

d Why is the spot rate different from the futures price on Day 1? Estimate the price on Day 5 and 6. (Hint: refer to the carry cost.)

Step by Step Answer: