The CFO of TRANSNATIONAL POULTRY FARMS is not satisfied with the Pecking Order solution to the companys

Question:

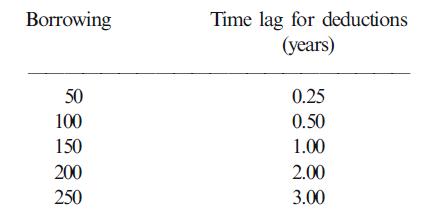

The CFO of TRANSNATIONAL POULTRY FARMS is not satisfied with the Pecking Order solution to the company’s financing problem. She feels uncomfortable about the large amount of debt in the Pecking Order optimum financing package. For example, if the company borrows too much, it is less likely to be able to deduct all the interest from current year taxable income. Deferment of interest deductions to subsequent years would reduce the PV of the tax benefit of the deductions. The following table contains her initial estimates of how long it would be before she could deduct the incremental interest from increased levels of borrowing.

If the company can borrow at 7%, calculate the effective tax rate applicable to the tax deductions for the incremental interest on each level of borrowing.

Step by Step Answer: