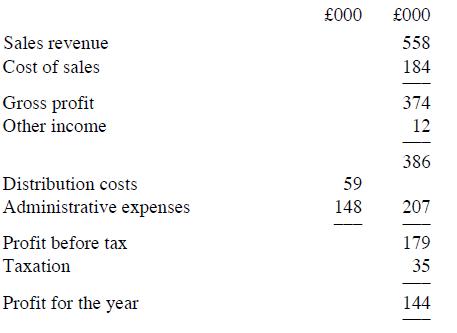

An extract from the draft statement of comprehensive income of Andisson Ltd for the year to 30

Question:

An extract from the draft statement of comprehensive income of Andisson Ltd for the

year to 30 April 2020 is as follows:

In January 2020, the company sold one of its business operations, incurring a loss of £17,000 on the sale. This loss is included in administrative expenses. The associated tax relief of £3,000 has been deducted when computing the tax expense shown in the draft statement of comprehensive income. The operation sold in January 2020 yielded sales revenue of £103,000 during the year to 30 April 2020. Related costs were cost of sales £38,000, distribution costs £2,000 and administrative expenses £20,000. The tax expense shown in the draft statement of comprehensive income includes £9,000 in relation to the profit made by this operation. Re-draft the extract from the statement of comprehensive income in accordance with the requirements of IFRS5 and draft a suitable note relating to discontinued operations which could appear in the notes to the financial statements.

Step by Step Answer: