Joan Hornby supplies the following information for the year ended 30 September 20*8: Required Prepare a trading

Question:

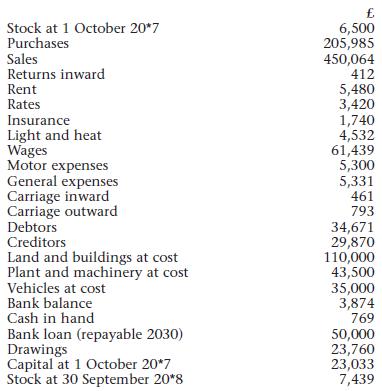

Joan Hornby supplies the following information for the year ended 30 September 20*8:

Required

Prepare a trading and profit and loss account for the year ended 30 September 20*8 and a balance sheet at that date.

Transcribed Image Text:

Stock at 1 October 20*7 Purchases Sales Returns inward Rent Rates Insurance Light and heat Wages Motor expenses General expenses Carriage inward Carriage outward Debtors Creditors Land and buildings at cost Plant and machinery at cost Vehicles at cost Bank balance Cash in hand Bank loan (repayable 2030) Drawings Capital at 1 October 20*7 Stock at 30 September 20*8 £ 6,500 205,985 450,064 412 5,480 3,420 1,740 4,532 61,439 5,300 5,331 461 793 34,671 29,870 110,000 43,500 35,000 3,874 769 50,000 23,760 23,033 7,439

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (9 reviews)

Trading and Profit Loss Account for the Year Ended 30 September 208 Particulars Amount Trading Accou...View the full answer

Answered By

Sayee Sreenivas G B

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The statements of comprehensive income and summarized statements of changes in equity of Alpha, Beta and Gamma for the year ended 30 September 2006 are given below: Notes to the financial statements...

-

On 1 June 20X2, Premier acquired 80 per cent of the equity share capital of Sanford. The consideration consisted of two elements: a share exchange of three shares in Premier for every five acquired...

-

A factory manufactures chairs and tables, each requiring the use of three operations: Cutting, Assembly, and Finishing. The first operation can be used at most 39 hours; the second at most 42 hours;...

-

Because the entries in the present value table (Table 13 - 3) are reciprocals of the corresponding entries in the future value table (Table 13 - 1), how can Table 13 - 3 be used to find the future...

-

If a company elects the deemed cost exemption, must it continue to use revaluation accounting subsequent to first-time adoption? Explain.

-

Which of the following is/are methods of reducing fraud losses once fraud has occurred? (There may be more than one right answer.) a. insurance b. regular backup of data and programs c. contingency...

-

Look back at the service continuum in Figure 123. Explain how the following points in the continuum differ in terms of consistency: (a) salt, (b) automobile, (c) advertising agency, and (d) teaching.

-

The data in Table 9E.1 represent individual observations on molecular weight taken hourly from a chemical process. The target value of molecular weight is 1,050 and the process standard deviation is...

-

On the Basis of the Follwing Data, determine the value of the inventory at the lower of cost or market

-

The following information is available for the year ended 31 March 20*8 for Dratesh Narewal: Required Prepare the trading and profit and loss account for the year ended 31 March 20*8 and a balance...

-

Leslie Harris provides the following information for the year ended 31 December 20*8: Required Prepare a trading and profit and loss account for the year ended 31 December 20*8 and a balance sheet at...

-

Head movement evaluations are important because disabled individuals may be able to operate communications aids using head motion. The paper Constancy of Head Turning Recorded in Healthy Young Humans...

-

Avery, an unmarried taxpayer, had the following income items: Salary Net income from a rental house 3 7 , 0 5 0 4 , 9 0 0 Avery has a 4 - year - old child who attends a child care center. Assume the...

-

California Lottery Let A denote the event of placing a $1 straight bet on the California Daily 4 lottery and winning. There are 10,000 different ways that you can select the four digits (with...

-

"Tamara Wiley glanced in the mirror before leaving her apartment and heading to her 8 a.m. class. She was having a bad hair day, so she had thrown on a scarf. Her quick check in the mirror told her...

-

Online Friends In a Pew Research Center survey of 1060 teens aged 13 to 17, it was found that 604 (or 57.0%) of those respondents have made new friends online. If the true rate is 50%, there is a...

-

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The bank statement for that day shows $9,500....

-

Strictly speaking, when an object acquires a positive charge by the transfer of electrons, what happens to its mass? Discuss what happens to its mass when it acquires a negative charge.

-

A consultant is beginning work on three projects. The expected profits from these projects are $50,000, $72,000, and $40,000. The associated standard deviations are $10,000, $12,000, and $9,000....

-

Explain what is meant by 'capital introduced'.

-

Is it possible to make drawings that exceed the profit earned in a year?

-

Give an example of drawings that the proprietor of an electrical goods store could make.

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App