Robin has his financial year-end on 31 January. He provides the following information: 700 is to

Question:

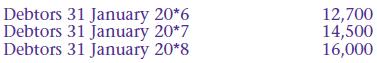

Robin has his financial year-end on 31 January. He provides the following information:

■ £700 is to be written off as a bad debt in the year ended 31 January 20*6.

■ £200 is to be written off as a bad debt in the year ended 31 January 20*8.

■ Robin wishes to make provision for doubtful debts of 2.5% of debtors outstanding at each year-end.

Required

Prepare for each year:

a) A bad debts account

b) A provision for doubtful debts account

c) An extract from the profit and loss account

d) An extract from the balance sheet.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: