1.2.1 The format recommended by the International Financial Reporting Standards for the preparation of a statement of profit or loss and other comprehensive income calculates

1.2.1 The format recommended by the International Financial Reporting Standards for the preparation of a statement of profit or loss and other comprehensive income calculates and shows the “gross profit” and the “profit for the year”. Write a brief description and explanation of these two terms. Also discuss whether you think the “profit for the year” can be greater than the “gross profit”. Provide reasons for your answer. (5)

1.2.2 The conceptual framework is the foundation that enhances the International Financial Reporting Standards (IFRS). Included in the framework is the definition of each of the

elements. With reference to the IFRS;

1.2.2.1 Provide the definition of an expense. (3)

1.2.2.2 Is the withdrawal of assets by the owner of the business in the form of “Drawings” classified as an expense? Motivate your answer with a brief explanation. (2)

1.2.2.3 The framework identifies certain qualities that make the information presented on financial statements more useful to the users of financial statements. List at least

two fundamental characteristics and three characteristics that enhance the fundamental characteristics. (5)

QUESTION TWO [25]

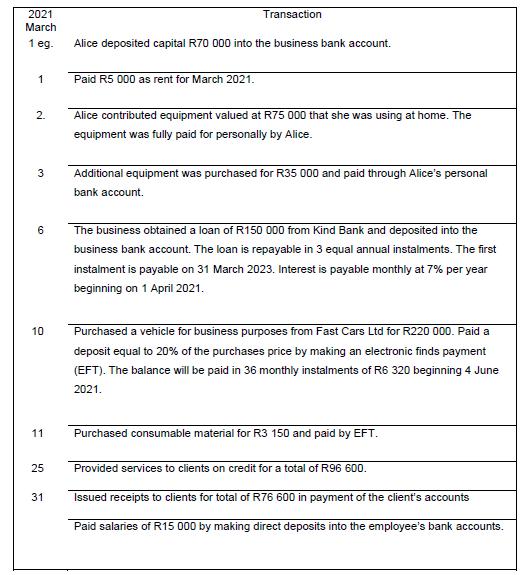

Alice Angle is an architect who set up her own on 1 March 2021. She supplied the following information about transactions for the first month ended 31 March 2021:

Required:

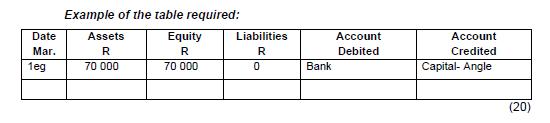

2.1 Process the above transactions through a table such as the one below. The transaction of 1March 2021above is used as an example. Record amounts without brackets to indicate an increase; amounts in brackets to indicate a decrease; and 0 (a zero) for no effect.

2.2 Calculate the amount owing by clients at 31 March 2021. (1)

2.3 Will the amount owing by the clients be shown as a current or non-current asset.

Motivate your answer. (1)

2.4 Calculate the amount of interest payable on 1 April to Kind Bank. (2)

2.5 Name the source document that we would use to record the services rendered to Alice Angle’s clients on credit. (1)

QUESTION THREE [25]

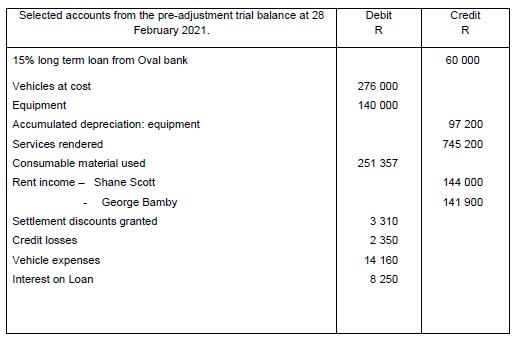

Pat Mendi owns Mobi Electronics which carry’s out repairs to all types of electronic devices and equipment. Pat provided the following list of selected account balances extracted from the pre-adjustment trial balance at 28 February 2021, the end of the current financial year:

Additional information:

1. Pat sub-let part of his premises which was rented out to the following two tenants:

1.1 Tenant: Shane Scott: His tenancy agreement confirms that Shane took occupation of the premises on 1 June 2020. There was no provision for increase in rent until 1 June 2021. Shane has already paid his rent for the period 1 June 2020 to 31 May 2021.

1.2 Tenant: George Bamby: His tenancy agreement confirms that he took occupation on1 March 2020. There was no provision for an increase in rent until 1 March 2021. George has paid his rent until 31 January 2021.

2. A debtor owing R1 500 was declared insolvent. R900 was received and deposited but not recorded. The unpaid balance of the debtors account is considered to be irrecoverable and must be written off as a credit loss.

3. Repairs to Pats personal car to the value of R2 500 was erroneously debited to the Vehicle expenses account. A correction needs to be recorded.

4. The interest on the loan from Oval Bank is still outstanding for February 2021. The loan was taken out on 1 April 2020 and is due to be paid on 31 March 2025.

5. Depreciation on Vehicles must be provided at 20% per year on the diminishing balance method. No vehicles were bought or sold during the current year.

6. All the equipment in use currently was bought on 1 March 2020. The estimated residual value of the equipment is R20 000. The equipment must be depreciated over the estimated useful life of 8 years using the fixed instalment method.

7. On 10 January 2021, a customer was charged R600 for the repair of her cell phone. Pat gave her a cash discount of R100 and the customer paid an amount of R500. This transaction was erroneously recorded as follows and included in the above list of accounts:

DR Bank R500

DR Settlement discount granted R100

CR Other expenses R600

Required:

Prepare the following for Mobi Electronics for the year ended 21 February 2021:

3.1 General journal entries to record the adjustments for additional information Number 1 to 7. Include a brief narration. (15)

3.2 The statement of profit or loss and other comprehensive income for the year ended 28 February 2021. (10)

QUESTION FOUR [12]

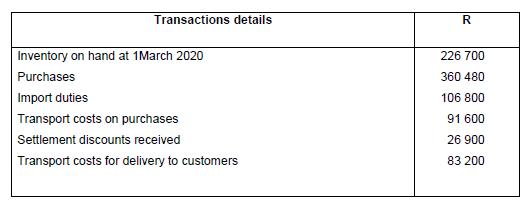

Bags Galore buy and sell a limited range of imitation leather bags. The following information was extracted from their financial records for the year ended 28 February 2021:

Additional information:

1. Inventory on hand at 28 February 2020 was as follows:

1 109 bags at R175 = R194 075

2. 97 bags at R115 were returned to suppliers and the necessary credit notes were

received. However, this has not yet been recorded.

3. Additional transport costs on purchases of R4 200 were incurred. This was paid by EFT but not yet recorded.

4. Additional import duties of R3 400 must still be recorded and paid.

5. Total sales for the year is as follows;

• 1 March 2020 to 28 February 2021; (Total number of bags sold = 5 300):

Sold 2 100 bags at R165 each; and

Sold 3 200 bags at R175 each.

6. Bags Wholesalers use the periodic inventory system to record their trading stock.

Required:

4.1 Prepare the trading section of the statement of profit or loss and other and

other comprehensive income for the year ended 28 February 2021. (10)

4.2 List at least two disadvantages of the Periodic Inventory System. (2)

QUESTION FIVE [13]

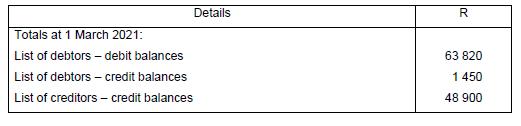

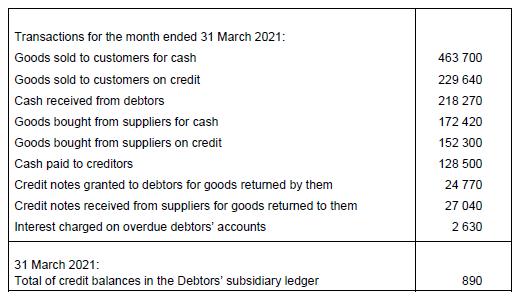

Ace Wholesalers’ have control accounts in the general ledger and subsidiary ledgers for their

individual debtors’ and creditors’ accounts. The balance in the control account is reconciled

with the total of the relevant subsidiary ledgers on a monthly basis. The following information

was extracted from the financial records of Ace Wholesalers for the month of March 2021:

Required:

Prepare the following for Ace Wholesalers for the month ended 31 March 2021:

5.1 Debtors’ control account (8)

5.2 Creditors’ control account (5)

2021 March Transaction 1 eg. Alice deposited capital R70 000 into the business bank account. 1 Paid R5 000 as rent for March 2021. 2. Alice contributed equipment valued at R75 000 that she was using at home. The equipment was fully paid for personally by Alice. Additional equipment was purchased for R35 000 and paid through Alice's personal bank account. 6 The business obtained a loan of R150 000 from Kind Bank and deposited into the business bank account. The loan is repayable in 3 equal annual instalments. The first instalment is payable on 31 March 2023. Interest is payable monthly at 7% per year beginning on 1 April 2021. Purchased a vehicle for business purposes from Fast Cars Ltd for R220 000. Paid a 10 deposit equal to 20% of the purchases price by making an electronic finds payment (EFT). The balance will be paid in 36 monthly instalments of R6 320 beginning 4 June 2021. 11 Purchased consumable material for R3 150 and paid by EFT. 25 Provided services to clients on credit for a total of R96 600. 31 Issued receipts to clients for total of R76 600 in payment of the client's accounts Paid salaries of R15 000 by making direct deposits into the employee's bank accounts. 3.

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Gross profit is the profit a company makes after deducting the costs associated with making and selling its products or the costs associated with providing its services Gross profit will appear on a c...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started